The introduction of Bitcoin exchange-traded funds (ETFs) in early 2024 marked a significant shift in digital asset trading. These ETFs have attracted substantial investment, resulting in noticeable patterns and effects on the broader cryptocurrency market. Known as the “drift effect,” these patterns involve sudden surges in Bitcoin trading volumes at specific times, reflecting heightened investor activity linked to ETF transactions.

A New Trading Rhythm

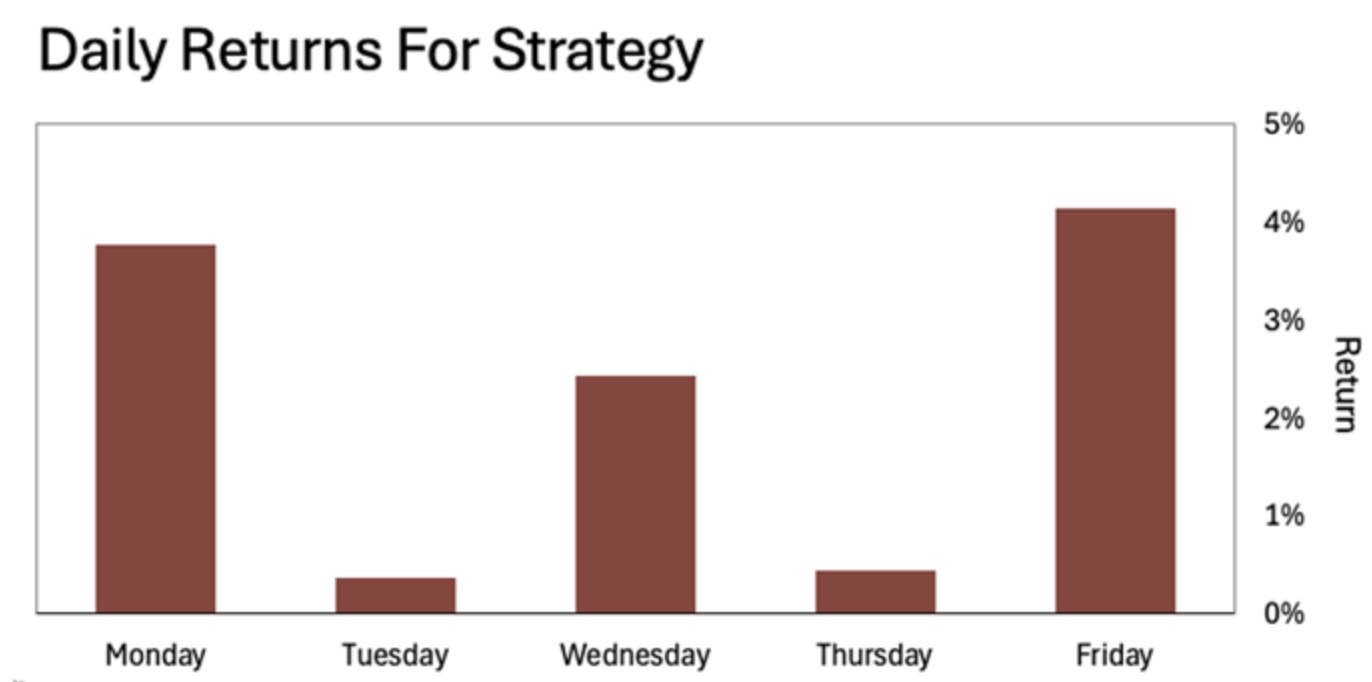

What’s fascinating about Bitcoin ETFs is their ability to bring institutional-grade investment strategies to retail investors. The result? A growing adoption of Bitcoin and other cryptocurrencies by traditional investors. These ETFs have been game-changers by increasing access and influencing market dynamics with their trading volumes. Two thirty-minute windows—at market open and around 3:30 p.m. ET—represent almost 9% of the entire day’s trading volume. These brief windows often generate more volume than a whole weekend.

Source: Tradingview Binace: BTC/USDT

Unpacking the Volume Surge

This phenomenon is unprecedented. Before Bitcoin ETFs, such concentrated spikes in trading volume did not exist. Much like traditional equities, traders are active at market open, eager to seize the day’s opportunities. The late afternoon window is especially intriguing, hinting at possible rebalancing activities by the ETFs. This behavior mirrors the equity markets, demonstrating how Bitcoin ETFs bring conventional market structures into the crypto space.

Impact on the Market and Opportunities

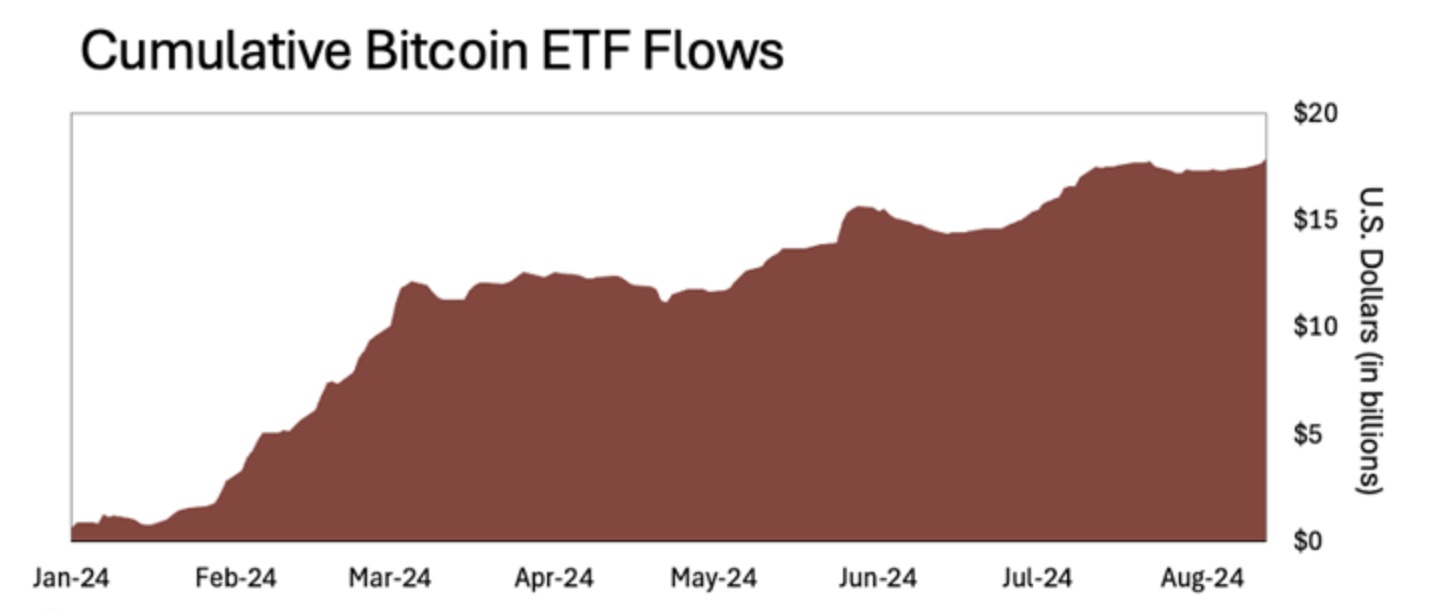

The introduction of Bitcoin ETFs showcases the relatively small size of the digital asset market and the significant impact these new financial instruments have had. Since their launch on January 11, 2024, Bitcoin ETFs have attracted more than $17 billion in capital flows in about eight months. This influx of fresh capital has increased liquidity and created numerous trading opportunities, highlighting the transformative potential of Bitcoin ETFs in the crypto market.

Source: Farside Investors

Broader Market Implications

The effect isn’t limited to Bitcoin alone. As capital flows into the crypto ecosystem, smaller cryptocurrencies with lower market capitalizations are also impacted. These shifts can lead to a ripple effect, boosting or lowering the prices of other digital assets in tandem with Bitcoin’s fluctuations.

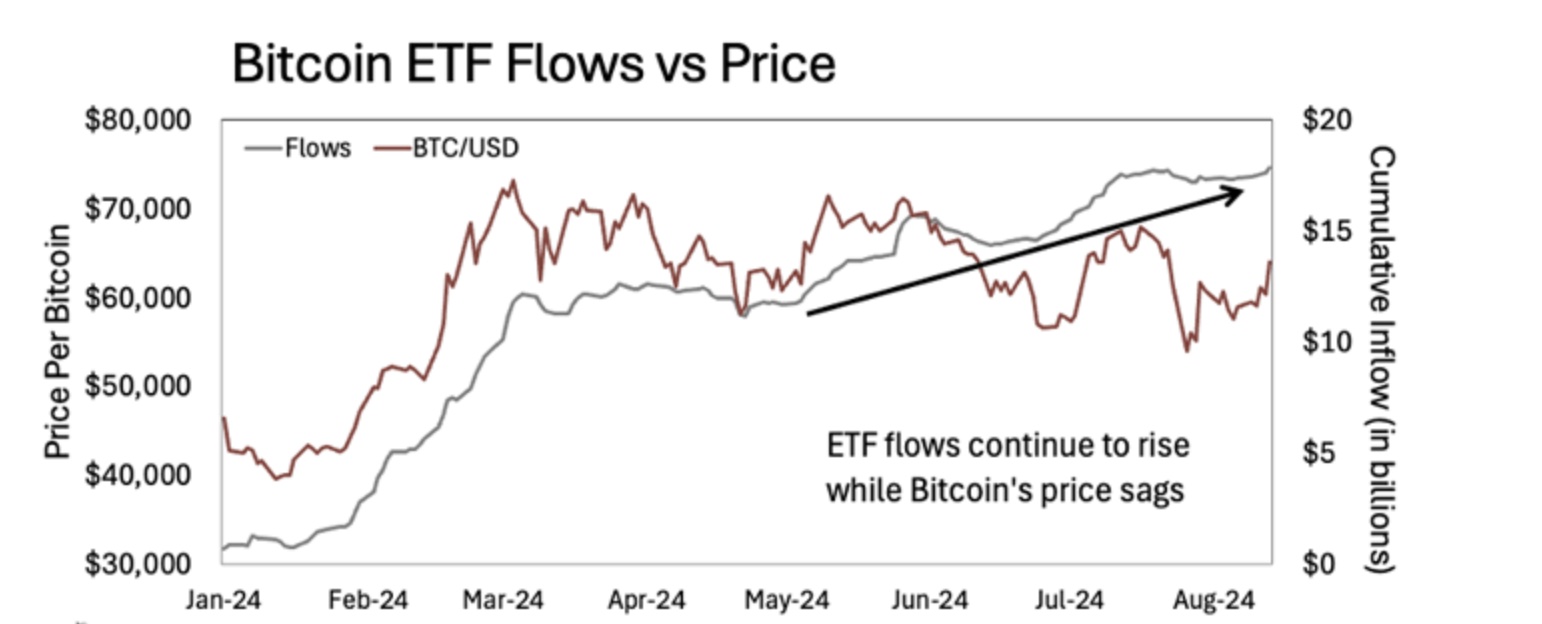

Before the ETFs officially launched, investors anticipated their debut, driving up Bitcoin’s price by over 70% in the 90 days before the launch. It was a classic case of “buy the rumor, buy even more on the actual news.” The market’s reaction was nothing short of extraordinary.

In the chart below, we can see this dynamic playing out. Price is moving sideways and sagging. Meanwhile, the capital inflows have risen 33% in the last three months.

Source: Farside Investors Tradingview

AI and Market Analysis: The Hidden Edge

At BitVision Research, we explore how artificial intelligence plays a crucial role in understanding these market dynamics. Different AI models—whether used for predicting price trends, analyzing trading patterns, or even for decision-making in high-frequency trading—each have their own set of strengths and weaknesses.

- Pattern Recognition: Machine learning algorithms excel at identifying patterns, like those caused by the Bitcoin ETF drift. These algorithms can process massive amounts of data to pinpoint when these trading surges will likely occur.

- Speed and Efficiency: AI offers speed—decisions can be made in fractions of a second, something human traders can’t replicate. In high-frequency trading, it’s a battle of milliseconds, where AI models can execute thousands of trades almost instantaneously.

- Adaptability: Unlike traditional trading systems, AI models continuously learn and adapt to new data, making them more resilient against market manipulations and unexpected changes. This adaptability can mean the difference between capitalizing on a trend and missing out.

Comparing the Methods

AI’s role in crypto trading is still evolving. Different models approach the same problem with varied techniques. For example, some focus on deep learning to understand intricate market behaviors, while others use predictive modeling to forecast price changes. It’s not just about having AI but choosing the right one tailored to specific market strategies.

Looking Ahead

The Bitcoin ETF drift effect is just the beginning. As these ETFs gain popularity, we expect even more volatility and new trading patterns to emerge. At BitVision, we are committed to diving deep into these trends, providing insights that inform and empower our readers to make smarter investment decisions.