The False Sense of Security in Consumer Staples

When markets become turbulent, many investors seek refuge in what they believe are defensive assets. The Consumer Staples Select Sector SPDR Fund (NYSE: XLP), managed by State Street Global Advisors, has been a popular choice. XLP tracks essential consumer industries, providing exposure to big names like Procter & Gamble, Coca-Cola, Walmart, and Costco.

The logic is simple: people need essential goods regardless of economic conditions, making consumer staples a safer investment during recessions. But as these companies face a potential economic downturn at peak valuations, the notion of their stability starts to unravel. XLP, currently trading at $82 per share, could see a sharp decline by March 2025.

The Pitfalls of Overvaluation and Weakening Demand

Although Consumer Staples stocks are often considered defensive, they’re not immune to economic forces. The following factors highlight why XLP could face a significant drop in value:

- High Valuations and Weak Fundamentals: Consumer Staples stocks, like Procter & Gamble and Costco, are trading at elevated price-to-earnings (P/E) multiples. Even a slight miss in earnings expectations could cause sharp declines. High valuations leave no room for error as the economy slows.

- Declining Pricing Power: Companies like PepsiCo and Coca-Cola have raised prices to maintain growth. However, these strategies backfire as consumers become more price-sensitive during an economic downturn. Profitability is under pressure, with falling sales volumes and fixed costs eating into margins.

- Changing Consumer Behavior: During recessions, even necessities like household goods and groceries face changes in demand. Shoppers opt for cheaper alternatives, and brands struggle to maintain market share. Dollar General and Conagra have reported increased demand for lower-priced items and higher promotions, indicating pressure on margins.

- Yield Disparity: XLP’s dividend yield of 2.63% is currently lower than the yield on 10-year U.S. Treasuries, which exceeds 3.6%. Investors seeking safety and yield are now finding better returns in less risky assets like Treasuries. This shift could lead to outflows from XLP and similar funds.

Analyzing the Numbers

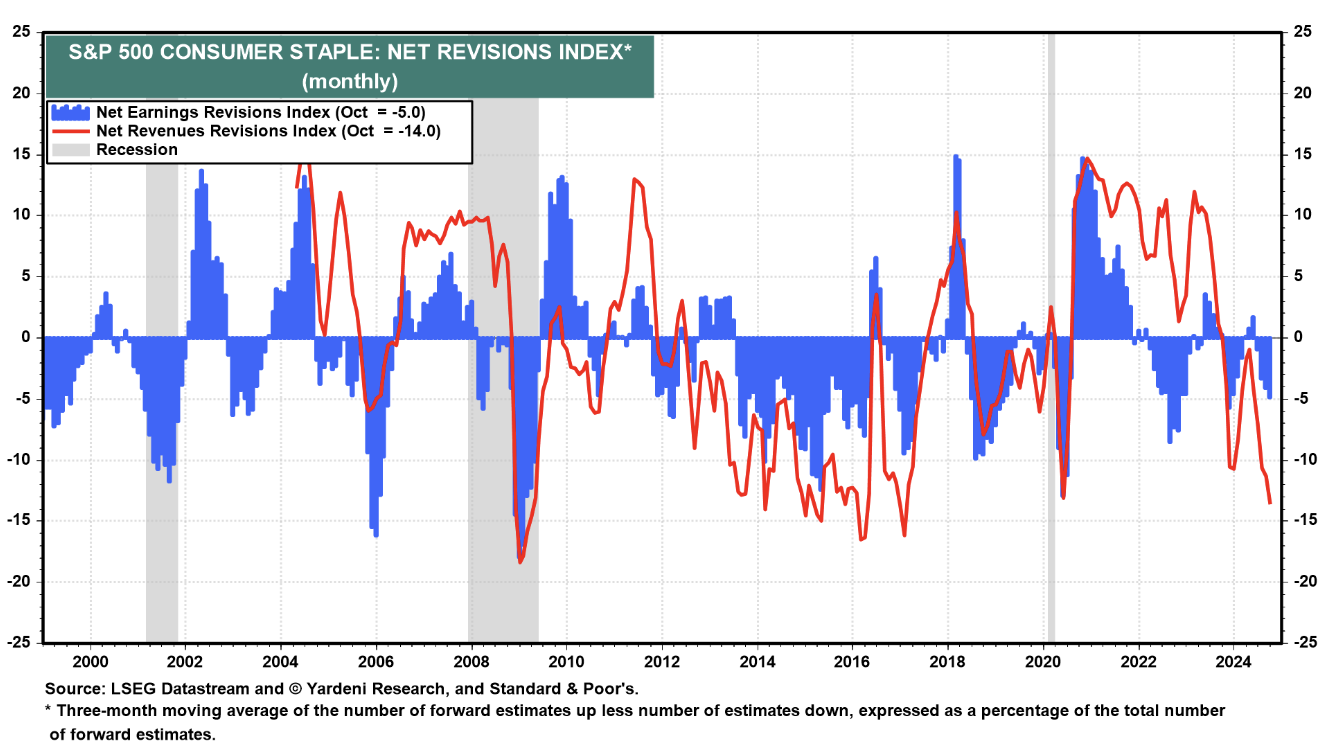

Recent data from Yardeni Research shows a negative trend in the Net Revisions Index for the S&P 500 Consumer Staples sector. Both earnings and revenue revisions have turned sharply negative. The Net Earnings Revisions Index is at -5.0, and the Net Revenues Revisions Index is at -14.0 as of October 2024. Such a steep decline in analyst expectations typically foreshadows a downturn in stock prices.

Why XLP Could Fall to $60 by March 2025

The following factors make a drop to $60—a nearly 30% decline—plausible:

- High Valuations and Margin Squeeze: Elevated P/E ratios, combined with higher input costs, could result in a severe pullback if companies underperform.

- Reduced Earnings and Profitability: Companies struggle to maintain profit margins as costs rise and consumers seek cheaper options.

- Negative Earnings Revisions: The downward revisions in earnings and revenue indicate that analysts see more downside risk than upside potential.

Bottom Line: Consider Alternative Defensive Plays

Instead of relying on Consumer Staples ETFs like XLP, investors should look to physical assets like gold or silver. These precious metals have historically provided a hedge against inflation and economic uncertainty. In conclusion, it’s time to rethink your defensive strategy. Using conservative assumptions, we can get to a $60 price target for XLP in the next recession.