“To Catch a Token” — the name plays off Alfred Hitchcock’s To Catch a Thief, filmed in the same French Riviera hills where Robinhood CEO Vlad Tenev just dropped a generational disruption.

But instead of a heist, Tenev laid out a three-phase plan to digitize Wall Street — transforming stocks into smart, tokenized assets that can be traded anytime, anywhere.

Finance, as we know it, is about to break free from the clock.

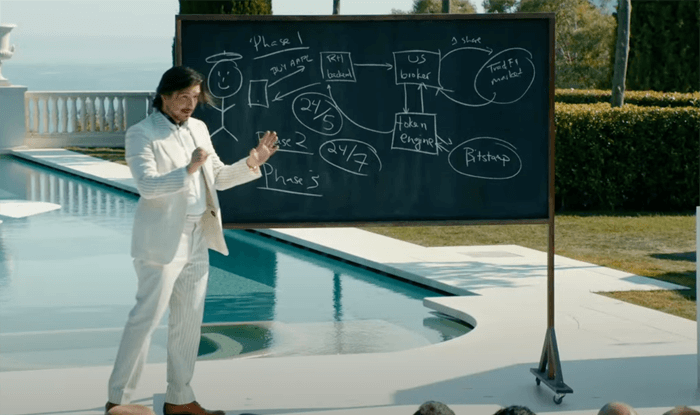

Tenev presenting at his To Catch a Token event | Source: Robinhood

🔄 The End of the 9-to-5 Market

For over 100 years, Wall Street kept tight hours. Stocks moved from 9:30 a.m. to 4 p.m., five days a week. That rhythm is about to dissolve.

At To Catch a Token, Tenev revealed how Robinhood is building a new financial core — one that runs 24/7. Tokenized stocks, permissionless rails, and direct user control are at the center of this plan.

And the first step? A “tokenization engine.”

🧠 From Stocks to Smart Assets

When you buy a stock on Robinhood, it traditionally passes through layers of brokers and custodians. Now, a new layer gets added: tokenization.

Each share gets converted into a digital token. It still acts like a normal share — it pays dividends and holds value — but now it’s programmable. When the user sells, the token gets burned.

No legacy middlemen. No delay. Just real-time, verifiable ownership.

Curious what this all means? McKinsey breaks down the basics of tokenization — and why it’s more than just a crypto trend. It’s infrastructure.

🌍 24/7 Stock Trading Is Here

Phase two leverages Robinhood’s acquisition of Bitstamp. The result: stock-like tokens can now trade around the clock, like crypto.

Night or day. Weekends too.

This step merges traditional equity markets with the always-on culture of digital assets. It unlocks liquidity, global participation, and faster reaction to news.

No more “Monday morning opens.” The market never closes.

⚙️ Robinhood Chain: The Core Engine

In phase three, we meet the real star: Robinhood Chain.

It’s a Layer 2 network built on Ethereum using Arbitrum’s technology. Fast, cheap, and permissionless. But most importantly — self-custody.

This Robinhood Chain means users own their tokenized assets directly. They can’t be locked out or frozen. Their holdings can be plugged into smart contracts, used for loans, or swapped for other assets.

Your Apple stock? Now, it can be used to borrow stablecoins.

Your dividend yield? It can be locked in for tuition, rent, or recurring income.

Finance becomes functional, not just theoretical.

💡 Not Just a Robinhood Story — This Is the Future

What Robinhood is building is bigger than an app upgrade. It’s a blueprint for next-gen finance.

Tokenization is the bridge from static assets to dynamic money. Stocks, bonds, real estate, and art — all become liquid, automated, and programmable.

We wrote about this shift in our deep dive:

🔗 From Bitcoin to Blockchain: The Real Growth Story of 2025

The takeaway? Tokenization is not a feature. It’s a new financial operating system.

🧭 For Investors, the Signal Is Clear

This trend isn’t about “crypto.” It is about how every asset will be owned, traded, and used in the next decade.

Banks won’t move fast enough. Brokerages will try to keep control. But the Robinhood Chain is open, borderless, and fast-moving.

At BitVision, this shift is where the smart capital will go next.

If you want to know where to park your money — look for platforms building infrastructure, not hype.

🎯 BitVision Final Thought

Finance isn’t becoming digital. It already is.

Robinhood just made the next move. The question is: Are you on-chain or off-grid?

Stay ahead. Stay tokenized.