In our previous article, “The Silver Mining Money Machine,” we explored how rising precious-metal prices magnify mining profitability — transforming modest cost advantages into explosive margin expansion.

But understanding why miners make money is only half the equation.

The real edge comes from knowing which stage of the mining lifecycle you are investing in — and when.

Every mining company lives in one of three evolutionary acts:

Producers. Developers. Explorers.

Each stage carries its own risk profile, capital dynamics, and upside potential. And in a precious-metal bull cycle, timing these stages correctly can mean the difference between steady compounding… and life-changing returns.

Let’s step inside the mining lifecycle.

Act I: Producers — The Cash Machines

Producers are already extracting metal from the ground and selling it into global markets. They generate revenue, cash flow, and operating leverage directly tied to metal prices.

This is where institutional capital lives. Pension funds, sovereign wealth funds, and large asset managers require liquidity, scale, and predictable reporting — all features of established producers.

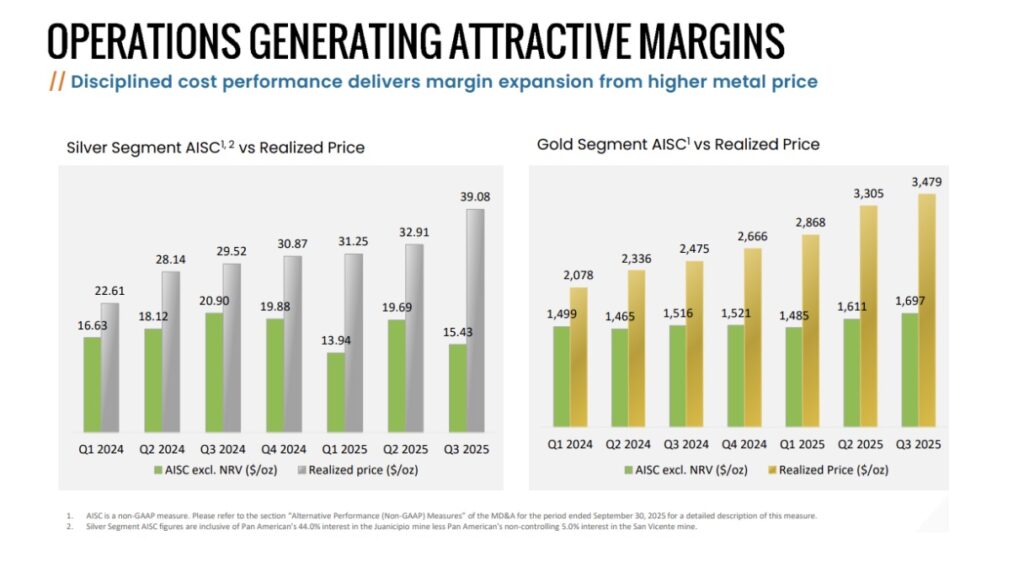

When gold or silver prices rise, producers feel the impact immediately.

Their costs increase slowly. Their selling prices rise instantly.

Margins expand exponentially.

Two years ago, many gold miners extracted gold at roughly $1,300–$1,500 per ounce and sold it at roughly $1,900 per ounce.

Today, those same ounces sell near $4,000 — while extraction costs have risen only modestly.

That gap is the mining money machine in action.

Producers typically lead in the early stage of a metals bull market, when smart capital positions first and liquidity remains selective. They offer the cleanest risk-adjusted exposure to rising metals — real businesses with real earnings, not speculation.

For most investors, producers form the core of their portfolio.

Act II: Developers — The Engineering Bottleneck

Developers have already discovered viable deposits.

They’ve drilled, surveyed, modeled, and proven resource estimates.

Now comes the difficult part:

Permitting. Infrastructure. Environmental approvals. Financing. Construction.

Developers usually generate little or no revenue — yet continue to burn capital. Their survival depends on disciplined fundraising, experienced leadership, and intelligent dilution management.

This is where many projects die.

But the few that succeed can deliver outsized returns, especially during the mid-stage of a metals bull cycle, when capital markets open and majors begin hunting acquisition targets to replenish declining reserves.

Investing in developers requires:

• Understanding geology

• Evaluating management credibility

• Tracking financing strategy

• Assessing jurisdictional risk

It is not beginner territory — but when done correctly, developers can outperform producers during the second act of a bull market.

Act III: Explorers — The Speculative Frontier

Explorers are the dreamers of the mining world.

A land claim. A geological theory. A drill program. A pitch deck.

Most will fail.

A few will find world-class deposits.

And an even smaller fraction will eventually evolve into producers — delivering returns that can exceed 50x or 100x over a decade.

In late-stage bull markets, when general investors finally rush into the sector, capital pours into explorers chasing asymmetric upside. This is when speculation peaks — and when both spectacular winners and brutal losses emerge.

The mining space is crowded with promotional stories.

Discipline and trusted research are essential.

Explorers are options on discovery — not investments in operating businesses.

They belong only in the portion of a portfolio reserved for high-risk asymmetric bets.

Understanding the Cycle Is the Real Edge

These three stages are not separate universes — they are connected steps in a continuous evolutionary chain.

Explorers feed developers.

Developers feed producers.

Producers recycle capital back into exploration.

But for investors, the timing of capital flows between these stages defines where returns concentrate during each phase of the metals cycle.

• Early bull market → Producers lead

• Mid bull market → Developers outperform

• Late bull market → Explorers explode

Knowing this sequence allows investors to rotate intelligently rather than chase headlines.

The Strategic Takeaway

Most mining fortunes are not made by guessing metal prices.

They are made by understanding where each company sits in the mining lifecycle—and aligning it with the macro capital cycle.

Producers remain the foundation.

Developers offer engineered upside.

Explorers provide optionality on discovery.

And as precious metals re-enter a long-term structural bull phase driven by monetary expansion, geopolitical fragmentation, and real-asset scarcity, this lifecycle knowledge becomes a decisive advantage.

Closing Loop to the Series

In “The Silver Mining Money Machine,” we showed how rising metals prices transform mining economics.

In this article, we’ve mapped where those profits emerge along the corporate evolution chain.

In the next piece, we’ll explore how institutional capital is re-entering the metals sector — and why the next two years may mark the most important reserve-replacement cycle since the early 2000s.

The machine is warming up again.

Those who understand the stages will arrive early, not late.