While the media obsesses over politics, savvy investors are reading between the lines.

The One Big Beautiful Bill Act (OBBBA)—just signed into law—is the most significant tax overhaul in U.S. history, realigning $12.5 trillion in federal policy to reshape global capital flows, re-industrialize America, and win the AI arms race.

📜 See the Full Bill – U.S. Congress

This bill isn’t just a tax bill; it’s also a comprehensive reform. It’s an industrial strategy by stealth.

And how it’s going to help the U.S. win the AI race.

The Bill’s Weapon: Accelerated Depreciation

OBBBA’s core lever? Companies can now immediately expense 100% of capital costs for “qualified production property,” including factories, laboratories, and AI infrastructure.

Old rule: Write off a $2 million factory over 20 years.

New rule: Write off the entire $2 million now.

That means massive upfront tax savings, better cash flow, and instant reinvestment.

Consider Tesla (TSLA)—now investing $8 billion to expand its U.S. production of EVs, batteries, and Optimus humanoid robots.

Previously, Tesla would’ve had to depreciate those costs slowly over decades. But under OBBBA, it can instantly deduct the full $8 billion, unlocking up to $1.6 billion in tax savings this year alone.

That’s not theoretical. It’s real cash, available now—fueling faster reinvestment, growth, and innovation.

This move is already sending industrial stocks up 30% since April, outperforming the S&P 500.

🧠 Explore how this impacts business owners and investors in our companion article.

The Biggest Winner: Artificial Intelligence

The real jackpot? AI infrastructure.

Big Tech hyperscalers—Amazon, Meta, Google, and Microsoft—are pouring hundreds of billions into AI data centers. These centers rely on GPUs, networking chips, and AI accelerators—all of which are now eligible for immediate write-offs.

Just one hyperscale data center costs $10 billion.

Even if only 25% qualify, that’s $2.5 billion in tax deductions, resulting in a $525 million savings in year-one taxes. That’s real cash to build more compute.

R&D Deductions: A Lifeline for Innovation

OBBBA didn’t stop at hardware.

It restores 100% deductibility of R&D expenses, reversing a 2022 rule that forced companies to amortize innovation over five years.

Now, every dollar spent on breakthrough AI or biotech research can be deducted immediately.

Meta has just invested $14.3 billion in Scale AI. Google bought Windsurf for $2.4B.

Startups like Anthropic and OpenAI are racing to absorb top talent, with $100M paydays now easier to justify.

Even beyond AI, OBBBA’s incentives are breathing new life into sectors like biotech. U.S.-based CRISPR pioneers—poised to thrive from AI-powered breakthroughs—are gaining fresh momentum. Just look at the ARK Genomic Revolution ETF (ARKG), which has surged 36% from its lows in the past three months.

NVIDIA: The Crowned Champion

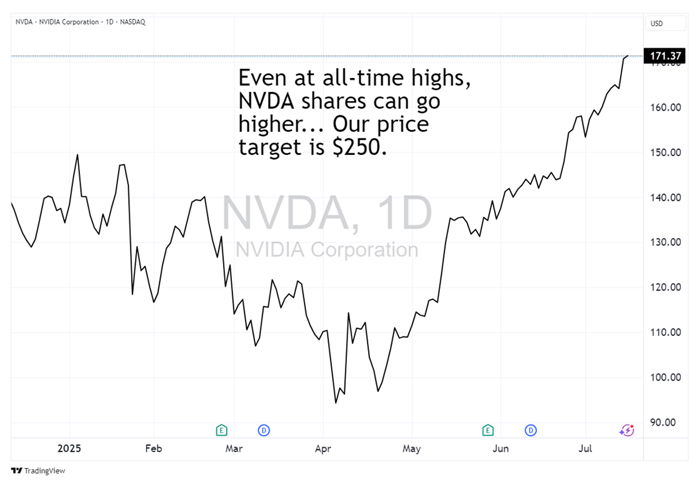

While the whole sector wins, NVIDIA may be the ultimate beneficiary.

Its GPUs are at the heart of AI compute. Thanks to OBBBA, every hyperscaler can now write off their NVIDIA orders upfront, making it more affordable to purchase more, faster.

It’s no coincidence that NVIDIA’s market cap topped $4 trillion. The flywheel is spinning: more deductions → more GPUs → more growth → more dominance.

Some analysts say $250/share is near. Others believe the top is not yet in sight.

What It Means for America—and You

With AI infrastructure spending set to reach $1 trillion/year by 2028, the U.S. has positioned itself as the global AI hub.

Much of that spending will go to AI data centers.

Last year, $435 billion was spent building out AI infrastructure. That number is expected to more than double, hitting $1 trillion annually by 2028.

This ACT is an industrial policy without tariffs. It’s supply-chain security without bans.

It’s reindustrialization by making America the most capital-friendly innovation zone in the world.

The bill may be complex. But the message is simple:

💡 Incentives are in place.

📈 Capital is flowing.

🤖 The AI race is on.

For those positioned wisely, this could unlock the decade’s most significant investment gains.