Wall Street’s most powerful institution just went all in on blockchain — and the world barely noticed.

🧊 Market Pullback, Institutional Entry

The past few weeks have been turbulent across the crypto market. Bitcoin’s correction erased billions in open interest, altcoins plunged, and sentiment turned bearish.

Yet behind this pullback, a very different kind of signal emerged — one that may define the next financial decade.

The Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, quietly invested $2 billion into Polymarket, a blockchain prediction-market platform recently approved by the U.S. Commodity Futures Trading Commission (CFTC).

It’s the most significant blockchain investment ever made by a traditional financial firm, valuing Polymarket at $8 billion pre-money.

For an industry obsessed with speculative cycles, this move marks something more profound: the institutionalization of on-chain finance.

🏛️ The Exchange That Powers the World

ICE isn’t a venture fund chasing hype. It’s the backbone of global finance — controlling exchanges for energy, mortgages, fixed income, and equity data.

If you’ve ever seen a live quote on your trading screen, there’s a good chance it came through ICE infrastructure.

By investing in Polymarket, ICE is signaling that the future of financial data will live on public blockchains.

Not behind NDAs, not inside Bloomberg terminals — but open, tokenized, and composable.

This $2B investment is Wall Street’s blockchain moment. The kind that doesn’t start with speculation, but with infrastructure.

🔮 Polymarket: Turning Reality Into Markets

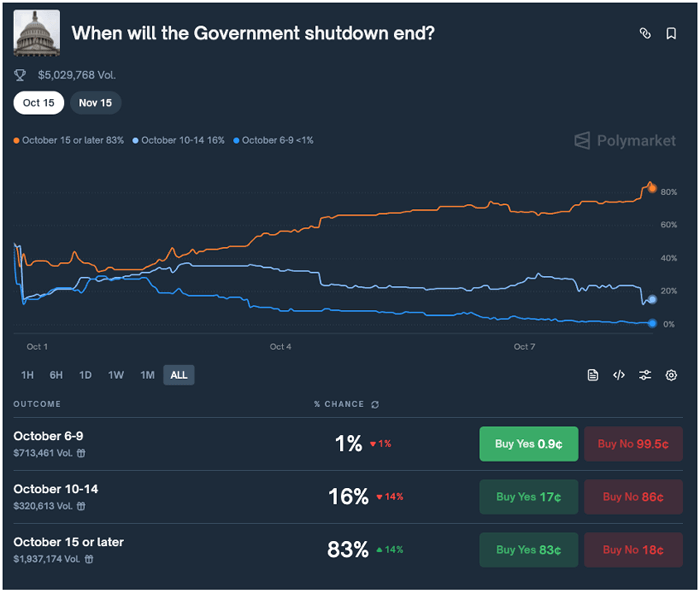

At first glance, Polymarket looks like a betting site. Users can “wager” on whether the government shutdown ends by a specific date, or who will win the next U.S. election.

But underneath, it’s a decentralized forecasting engine — a platform that tokenizes truth.

Each event is expressed as a pair of tokens — “Yes” or “No.”

Prices reflect collective belief. Real money backs every position.

When events resolve, winners split the pot.

The result: a living, on-chain consensus of probability.

For ICE, this is more than entertainment. It’s a data revolution.

Every trade creates a real-time signal about human expectations — the ultimate input for traders, risk managers, and AI models that forecast market outcomes.

Source: Polymarket.com

⚙️ From Prediction to Financial Primitive

Polymarket’s architecture is deceptively simple but revolutionary. It introduces a new financial primitive: event-driven liquidity.

Think of it like options — but instead of betting on price levels, you’re pricing outcomes.

“Will the Fed cut rates in March?”

“Will Tesla beat Q4 earnings?”

“Will Congress pass a spending bill?”

Each answer becomes a tokenized market.

It creates a new universe of derivatives — real-world event derivatives — with potentially trillions in liquidity.

As ICE builds data services around these event streams, prediction markets could evolve into tools for hedging macro risk, modeling political volatility, and tokenizing insurance.

In essence, Polymarket isn’t about gambling — it’s about creating financial infrastructure for uncertainty.

⚖️ The Regulatory Greenlight

This $2B deal couldn’t have existed a year ago.

Under the prior administration, prediction markets sat in regulatory limbo, and crypto firms faced enforcement-first policies.

Now, with Project Crypto and a coordinated CFTC–SEC framework emerging, the U.S. is repositioning itself as the world’s crypto capital.

Polymarket’s approval marks the first institutional validation of on-chain markets as compliant financial instruments.

ICE’s move is thus both a business decision and a policy signal — a recognition that America’s capital markets are going on-chain.

🧭 BitVision Analysis: What This Means for the Industry

The $2B ICE–Polymarket deal represents a convergence of data, markets, and blockchain — the foundation for what BitVision defines as the On-Chain Economy Era.

Here’s how it reshapes the landscape:

- Financial Data Becomes Decentralized.

- ICE can now tokenize and stream prediction-market data globally — bypassing legacy systems. This transforms data itself into an on-chain asset class.

- Prediction Markets Evolve Into Hedges.

- Institutional desks can hedge exposure to real-world events, including rate cuts, elections, legislation, and geopolitical shocks.

- Regulatory Shift Opens the Floodgates.

- With CFTC approval, event markets may soon expand into tokenized futures, insurance, and structured products — bridging DeFi and TradFi.

- AI + Blockchain Integration Accelerates.

- Event data from Polymarket is a goldmine for machine learning. Predictive AI systems can now train on real-time, market-verified human expectations — an advantage for quant firms and sovereign investors alike.

📉 The Pullback Before the Breakthrough

Today’s correction feels painful, but it mirrors early 2016 — when traditional markets doubted crypto’s legitimacy just before the institutional wave began.

The ICE–Polymarket deal is a moment of that kind. It’s quiet, technical, and easy to miss — until it changes everything.

Smart money isn’t leaving crypto. It’s repositioning from speculation to infrastructure.

From memecoins to market primitives.

From volatility to verification.

🚀 The Future: Markets That Trade Truth

If data is the new oil, then Polymarket is building the refinery — where truth becomes tradable and belief becomes liquidity.

With ICE’s weight behind it, this model could evolve into the Bloomberg Terminal of the blockchain era — an open, global layer of financial intelligence.

So yes, this might be the biggest $2B crypto bet in history.

But more importantly, it’s the best that turns blockchain into Wall Street’s backbone.

✍️ By Michelle Tan | BitVision.ai

Follow BitVision on X ( @DefiFinace )for deep dives into blockchain, AI, and the new financial order.