- DBS Bank Purchases ETH:

- Details: Singapore’s largest bank, DBS, has made a significant investment by purchasing 173,753 ETH, valued at approximately $650 million. This move is part of a broader trend of institutional investments into cryptocurrency, signaling confidence in Ethereum’s long-term value proposition. DBS’s purchase highlights the growing interest from traditional financial institutions in integrating cryptocurrencies into their portfolios.

- Details: Singapore’s largest bank, DBS, has made a significant investment by purchasing 173,753 ETH, valued at approximately $650 million. This move is part of a broader trend of institutional investments into cryptocurrency, signaling confidence in Ethereum’s long-term value proposition. DBS’s purchase highlights the growing interest from traditional financial institutions in integrating cryptocurrencies into their portfolios.

- Spot Bitcoin ETF Approval:

- Details: Goldman Sachs has highlighted the approval of a spot Bitcoin ETF as a pivotal moment for the cryptocurrency market. This approval is considered a “big psychological turning point” as it allows more institutional and retail investors to gain exposure to Bitcoin through traditional investment vehicles. A spot ETF tracks the actual price of Bitcoin, providing a more direct investment compared to futures-based ETFs, which can have pricing discrepancies.

- Details: Goldman Sachs has highlighted the approval of a spot Bitcoin ETF as a pivotal moment for the cryptocurrency market. This approval is considered a “big psychological turning point” as it allows more institutional and retail investors to gain exposure to Bitcoin through traditional investment vehicles. A spot ETF tracks the actual price of Bitcoin, providing a more direct investment compared to futures-based ETFs, which can have pricing discrepancies.

- Ethereum ETF Issuers:

- Details: The U.S. Securities and Exchange Commission (SEC) has taken a significant step by notifying Ethereum ETF issuers to submit their first draft S-1 forms. This move suggests that Ethereum ETFs might soon become available, potentially increasing institutional investment in Ethereum. ETFs (Exchange-Traded Funds) are popular investment vehicles that can bring more liquidity and broader market participation to Ethereum.

- Details: The U.S. Securities and Exchange Commission (SEC) has taken a significant step by notifying Ethereum ETF issuers to submit their first draft S-1 forms. This move suggests that Ethereum ETFs might soon become available, potentially increasing institutional investment in Ethereum. ETFs (Exchange-Traded Funds) are popular investment vehicles that can bring more liquidity and broader market participation to Ethereum.

- Bitcoin Withdrawals:

- Details: A substantial $700 million worth of Bitcoin was withdrawn from the Kraken exchange, following a previous withdrawal of over 30,000 Bitcoin, valued at $2 billion, from various exchanges. These large withdrawals are often interpreted as investors moving their assets to long-term storage, indicating a bullish sentiment and confidence in Bitcoin’s future value. Such movements can reduce the available supply on exchanges, positively impacting Bitcoin’s price.

- Details: A substantial $700 million worth of Bitcoin was withdrawn from the Kraken exchange, following a previous withdrawal of over 30,000 Bitcoin, valued at $2 billion, from various exchanges. These large withdrawals are often interpreted as investors moving their assets to long-term storage, indicating a bullish sentiment and confidence in Bitcoin’s future value. Such movements can reduce the available supply on exchanges, positively impacting Bitcoin’s price.

- Fidelity’s Bitcoin Purchase:

- Details: Fidelity, one of the largest asset management firms, has purchased 1,740 Bitcoin worth over $116 million. Fidelity’s continued investment in Bitcoin underscores its belief in Bitcoin’s role as an asset in a diversified portfolio. Institutional purchases often lead to increased trust and adoption of Bitcoin among retail investors, further legitimizing cryptocurrency as a mainstream investment.

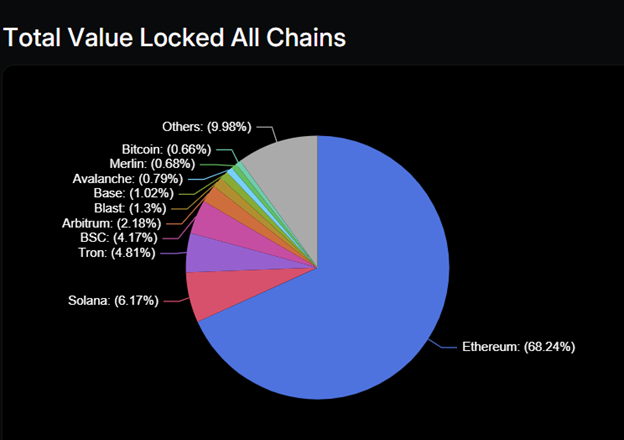

This chart shows the total value locked (TVL) on all the major blockchains.

Despite recent advancements, Ethereum remains the leading smart contract platform. The Total Value Locked (TVL) on prominent blockchains is a crucial indicator of the total value locked in DeFi protocols, reflecting user engagement and confidence. Ethereum’s substantial TVL signifies a flourishing ecosystem that attracts developers and cultivates progress and creativity.

A significant portion of Ethereum’s recent expansion is credited to Coinbase’s Base chain, constructed on the Ethereum network. Implementing the EIP-4844 update has facilitated layer 2 solutions such as Base to reduce transaction fees to as little as one cent drastically. This development has fueled speculative trading activities, positioning Base as an appealing platform for trading and investment activities during bullish market trends. Leveraging Coinbase’s broad user base has significantly accelerated the Base’s growth trajectory by bringing in new users.

Maintaining optimism is essential for Ethereum’s scalability, particularly with ambitions to accommodate one billion users on the network. Layer 2 solutions like Optimism are crucial in addressing fragmentation issues by enabling seamless communication across different L2 networks called “OP chains.” Prominent projects like Base and World Coin have integrated into the OP Stack, establishing Optimism as a frontrunner in the market.

The team driving Optimism comprises highly skilled blockchain developers and researchers, including Karl Floersch, co-founder of the Ethereum Foundation. With a substantial funding injection of $178.6 million from reputable investors like a16z and Paradigm, Optimism enjoys robust institutional backing.

In a notable move, a16z recently made a significant investment of $90 million in OP tokens, marking one of their most substantial crypto investments thus far.

Despite encountering some performance hurdles recently, Optimism remains fundamentally solid. It boasts an adept team and substantial financial support from top investors. It leads in critical metrics such as total addresses and daily development activity—signifying a resilient ecosystem poised for promising growth prospects.

The recent positive developments in cryptocurrency, encompassing substantial institutional investments and advancements in regulatory acceptance, fortify an optimistic outlook for cryptocurrencies moving forward. Ethereum’s supremacy in smart contracts and the strategic significance of layer 2 solutions like Optimism are pivotal for fostering growth and scalability within the ecosystem. As the market landscape evolves, these developments underscore sustained interest from institutional entities and retail participants within the crypto domain.