What does June 2024 tell us about the crypto market’s pulse? How do the movers and shakers navigate this ever-evolving landscape? Let’s unravel the story behind the numbers and deals shaping the future.

Market Pulse Check

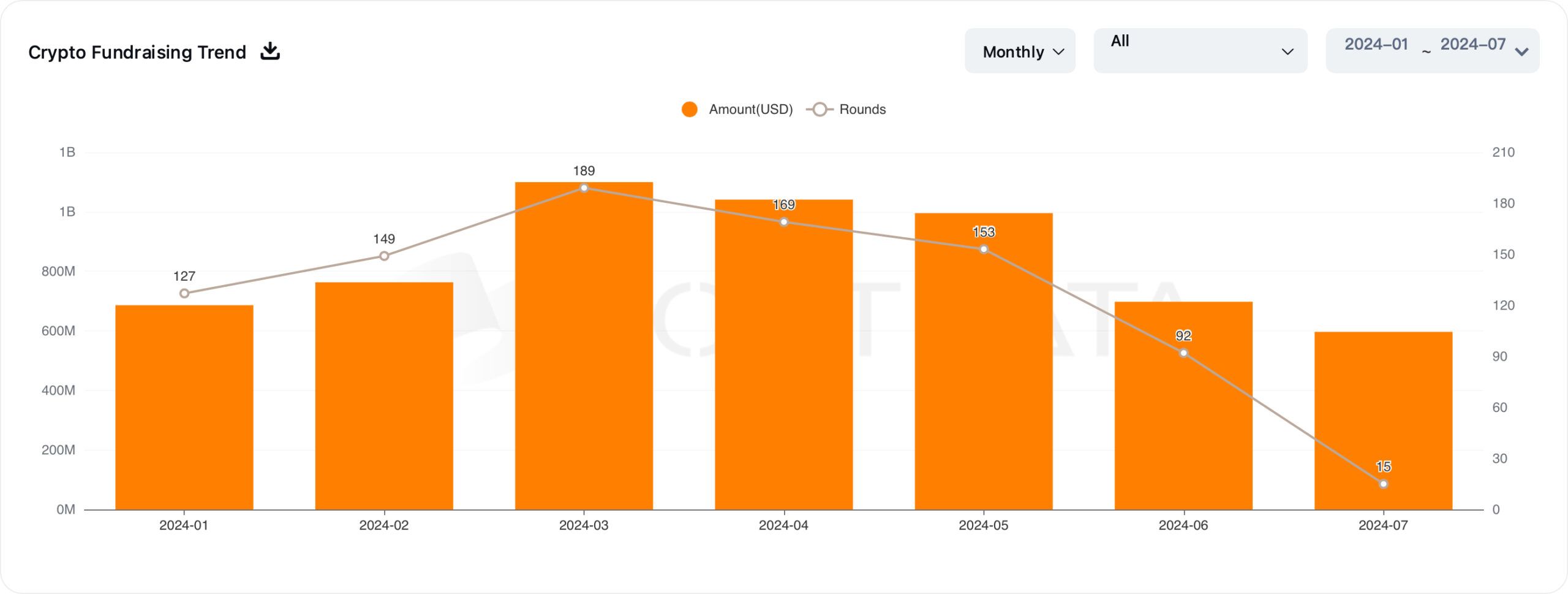

June’s crypto venture capital investment totaled $697 million, a 30% drop from May’s staggering $990 million. But before you start ringing alarm bells, consider this: it’s a 42% jump from the $480 million raised in June 2023. The market is more resilient and dynamic than it seems at first glance.

The Investment Landscape

RootData reports a sharp decrease in publicly disclosed crypto VC investments, down to 92 from May’s bustling 153. This 40% drop might seem daunting, but let’s consider it. This month, compared to the 87 projects recorded in June 2023, shows a slight increase. It’s a sign of a market maturing, becoming more selective and strategic.

Major Moves and Strategic Shifts

Robinhood Acquires Bitstamp for $200 Million.

June’s headline-grabber was Robin Hood’s $200 million acquisition of Bitstamp. This isn’t just another deal; it’s a strategic powerhouse move. Robinhood aims to integrate Bitstamp’s extensive licenses and global registrations, enhance its crypto services and step into the institutional space with a ready-made infrastructure.

GRIID’s $155 Million M&A Deal

GRIID also made waves with a $155 million merger and acquisition deal. Although the details are sparse, this significant move underscores ongoing strategic consolidations within the industry.

Hut 8 Mining’s $150 Million Investment

Hut 8 Mining’s $150 million strategic Investment further highlights the sustained interest in crypto mining, reinforcing the sector’s long-term potential and profitability.

Sector Breakdown

Let’s dissect where the money is flowing:

- DeFi: Leading with 20% of total investments, signaling robust confidence in decentralized finance.

- NFT/GameFi: Grabbing 18%, reflecting the ongoing buzz around digital collectibles and gaming finance.

- L1/L2: Securing 11%, indicating steady interest in foundational blockchain technologies.

- Tools and Wallets: Capturing 8%, highlighting the need for robust infrastructure and security.

- AI: Receiving 9%, showcasing the promising intersection of artificial intelligence and blockchain.

- CeFi: Coming in lowest at 4%, suggesting a cautious approach towards centralized finance.

- RWA and DePIN: Despite the hype, real-world assets and decentralized physical infrastructure networks secured only 6% of the investments.

Beyond the Numbers

The fluctuations in funding volumes highlight a maturing market. Strategic investments are becoming more selective, reflecting broader economic factors and a more discerning investor base. The drop from May may seem significant, but the year-over-year growth indicates a healthy, evolving market.

Robin Hood’s acquisition of Bitstamp isn’t just about expanding services; it’s about leveraging Bitstamp established reputation for transparency and trust. This deal will enhance Robinhood trading experience and compliance, significantly impacting the institutional space.

Conclusion

June 2024’s crypto investment landscape, marked by significant deals and shifting trends, tells a story of resilience and strategic evolution. Despite short-term fluctuations, the market’s dynamism and selective investment strategies signal a bright future. Investors and stakeholders must stay sharp, ready to navigate the ever-changing tides of the crypto world.

Stay curious, stay informed, and watch as the crypto narrative unfolds in the coming months.