Sunday afternoons are usually for brunches and naps, but not for President Trump. Instead, he decided it was the perfect time to drop a bombshell: the United States is moving forward with a crypto strategic reserve.

The idea isn’t entirely new. Trump’s executive order from January 23, 2025—Strengthening American Leadership in Digital Financial Technology—already hinted at the possibility of the federal government stockpiling digital assets. But what caught everyone off guard was how fast it all materialized. Even more surprising? Trump named the first three cryptos to be included: Ripple (XRP), Solana (SOL), and Cardano (ADA).

Strategic Choices or Just Vibes?

Picking Ripple, Solana, and Cardano makes sense when you look at their market positions—third, sixth, and eighth most prominent by market cap, respectively. But why these and not others? Let’s break it down:

- Ripple (XRP): A payments powerhouse built for cross-border transactions, Ripple already works with over 300 financial institutions across 70+ countries. It’s centralized (yes, we said it), and that’s a plus for governments looking for control. It just launched a USD stablecoin that aligns perfectly with the administration’s focus on digital dollar regulation.

- Solana (SOL): The “Formula 1” of blockchains—fast, cheap, and built for high transaction volumes. If speed is the game, Solana is winning. Think of it as the Visa network of the crypto world, handling microtransactions and smart contracts like a champ.

- Cardano (ADA): The nerd of the trio. Focused on security and governance, Cardano isn’t the fastest or the cheapest, but it’s one of the most academically rigorous projects. Governments love the idea of well-structured, well-documented blockchain tech.

So, what didn’t cut?

- Tether (USDT) & USDC: Being stablecoins, they don’t serve the purpose of an appreciating digital reserve.

- Binance (BNB): China ties? Nope. Not happening.

- Dogecoin (DOGE): Fun for memes, not for national reserves.

Market Goes Wild

Unsurprisingly, naming specific cryptos sent the market into a frenzy:

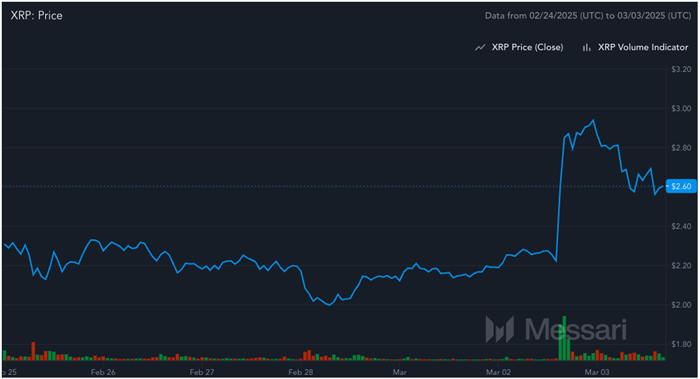

XRP surged 32%.

One-Week Chart of Ripple (XRP) | Source: Messari

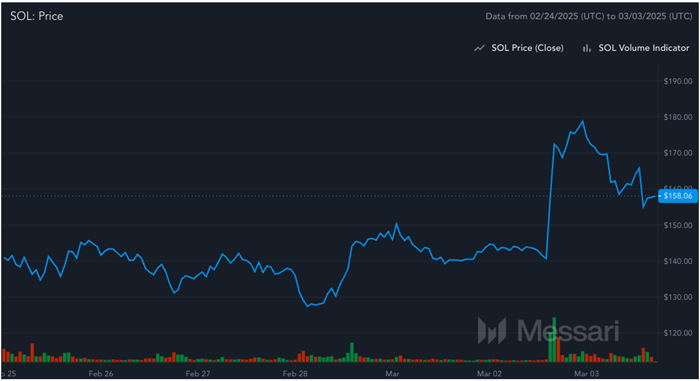

Solana jumped 27%.

One-Week Chart of Solana (SOL) | Source: Messari

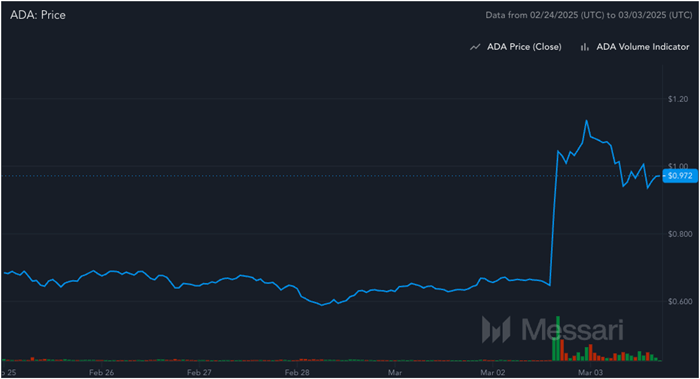

Cardano skyrocketed 76%.

One-Week Chart of Cardano (ADA) | Source: Messari

Then came the moment of panic. Where were Bitcoin (BTC) and Ethereum (ETH)?

They were so evident that they didn’t need a mention. A quick follow-up post on Truth Social clarified that BTC and ETH would be included, alongside additional assets to be named later. The market exhaled, and prices adjusted accordingly:

- Ethereum gained 15%.

- Bitcoin climbed 11%.

What Happens Next?

Now, the real work begins. The Working Group on Digital Asset Markets, chaired by venture capitalist David Sacks (yes, he’s now officially the government’s go-to for AI and crypto), will need to navigate Congress, the U.S. Treasury, and the FBI to bring this vision to life.

Meanwhile, Washington is already buzzing:

- First-ever White House crypto summit: Hosted by Sacks and Bo Hines on March 7, bringing together key blockchain executives.

- Congressional Crypto Caucus: Representatives Tom Emmer and Ritchie Torres launched to push pro-crypto legislation.

- SEC flip-flop: From “let’s sue everyone” to “let’s be friends.” Cases against MetaMask, Consensys, Coinbase, Uniswap, Gemini, Opensea, and Kraken have been dropped. Expect Ripple’s case to be dismissed soon.

The Bigger Picture: Blockchain & AI’s Future

There’s a reason why Sacks is leading both AI and crypto. These two sectors are unstoppable and set to unleash the biggest productivity boom in history. AI agents powered by Web3 and blockchain could autonomously manage digital assets, make transactions, and provide services, ushering in a new era of decentralized economic activity.

For investors, the next 12-24 months are looking incredibly bullish. Years of regulatory hurdles are clearing, and innovation is set to explode. But remember, logic is optional in crypto, and volatility is inevitable.

At Bitvision.ai, we always ask the fundamental questions:

- What’s the utility of a blockchain?

- Who’s using it?

- How does it balance security, scalability, and decentralization?

- Who’s pulling the strings?

- What’s the monetary policy?

- What’s the regulatory landscape?

- Is there a real network effect?

- And, of course, are there any red flags?

With the U.S. treating crypto as a strategic asset, we’re officially in the next blockchain adoption phase. Last article Post-SEC Victory and Banking Revolution have more details. Buckle up because this ride is only getting started.