First, the bad news: Tariffs are back—and they’re not playing nice.

President Trump’s sweeping tariff plan, pitched as a tool to reclaim economic control, is starting to spook more than just foreign exporters. The Federal Reserve is increasingly alarmed that these tariffs may unleash something trickier: stubborn inflation that refuses to disappear.

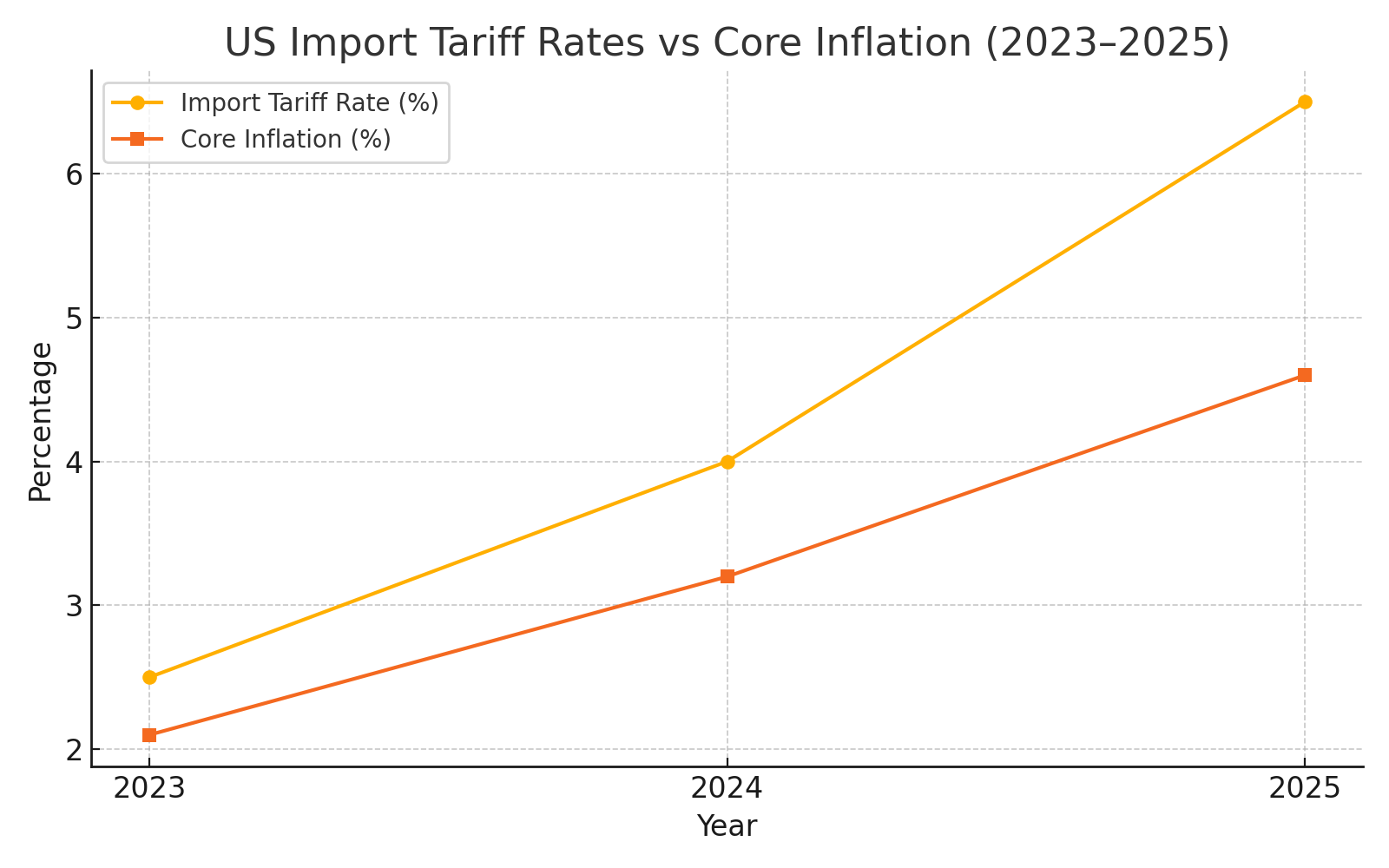

US Import Tariff Rates vs. Core Inflation (2023-2025)

What’s the Fed worried about?

Inflation. But not just any inflation—sticky inflation.

Unlike short-lived price spikes caused by supply chain hiccups or energy shocks, tariff-driven inflation embeds itself deeper into the economy. Goods become more expensive to make, and companies pass those costs on to consumers. Prices rise and stay high.

Fed officials are calling it early. Boston Fed President Susan Collins says, “Tariff effects are broader than many Americans realize.” Dallas Fed’s Lorie Logan warns that if inflation expectations shift, the Fed might be forced to tighten even more.

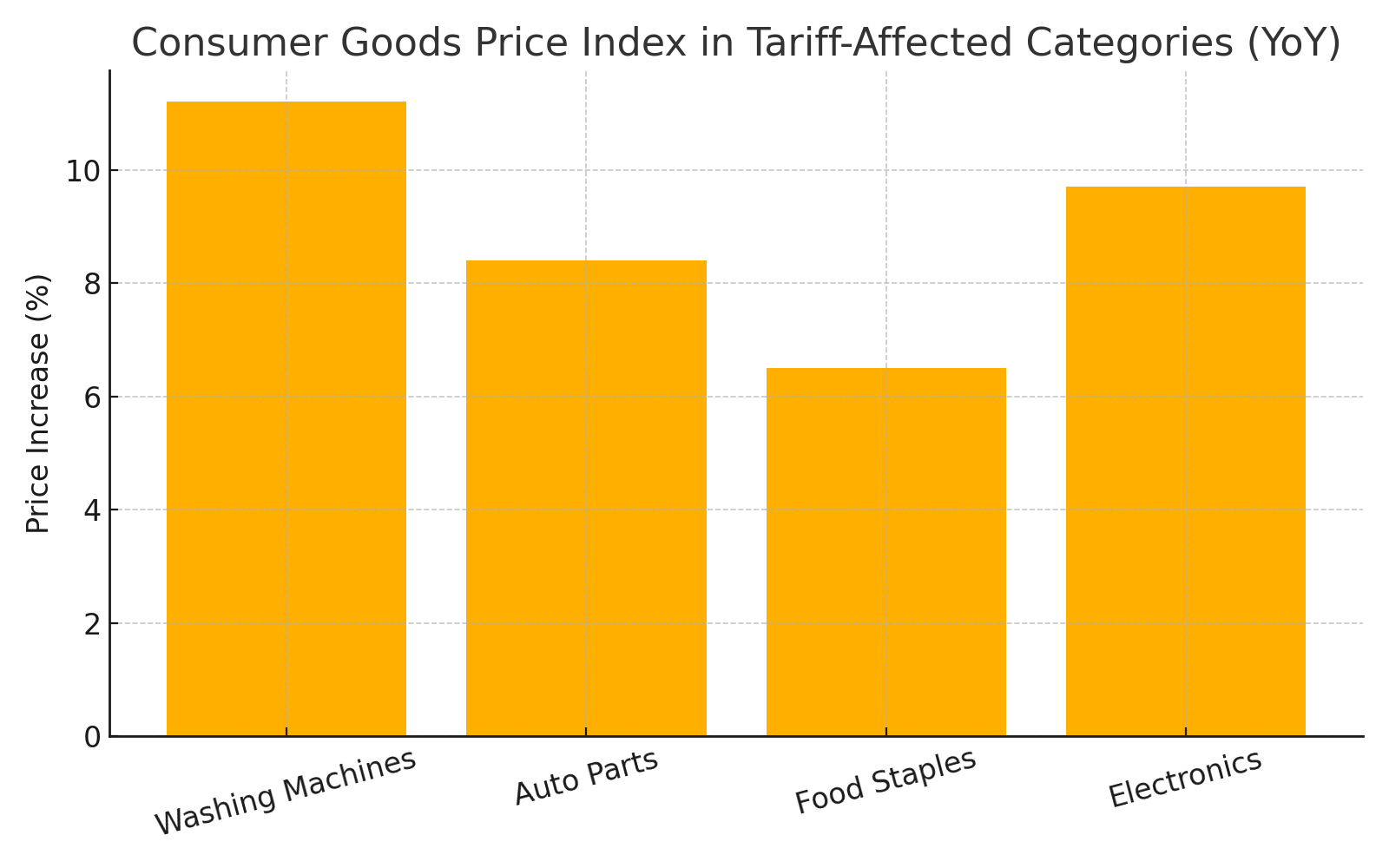

Consumer Goods Price Index in Tariff-Affected Categories (YoY)

The economy’s double whammy

Tariffs do two things at once:

- Push prices up

- Slow growth down

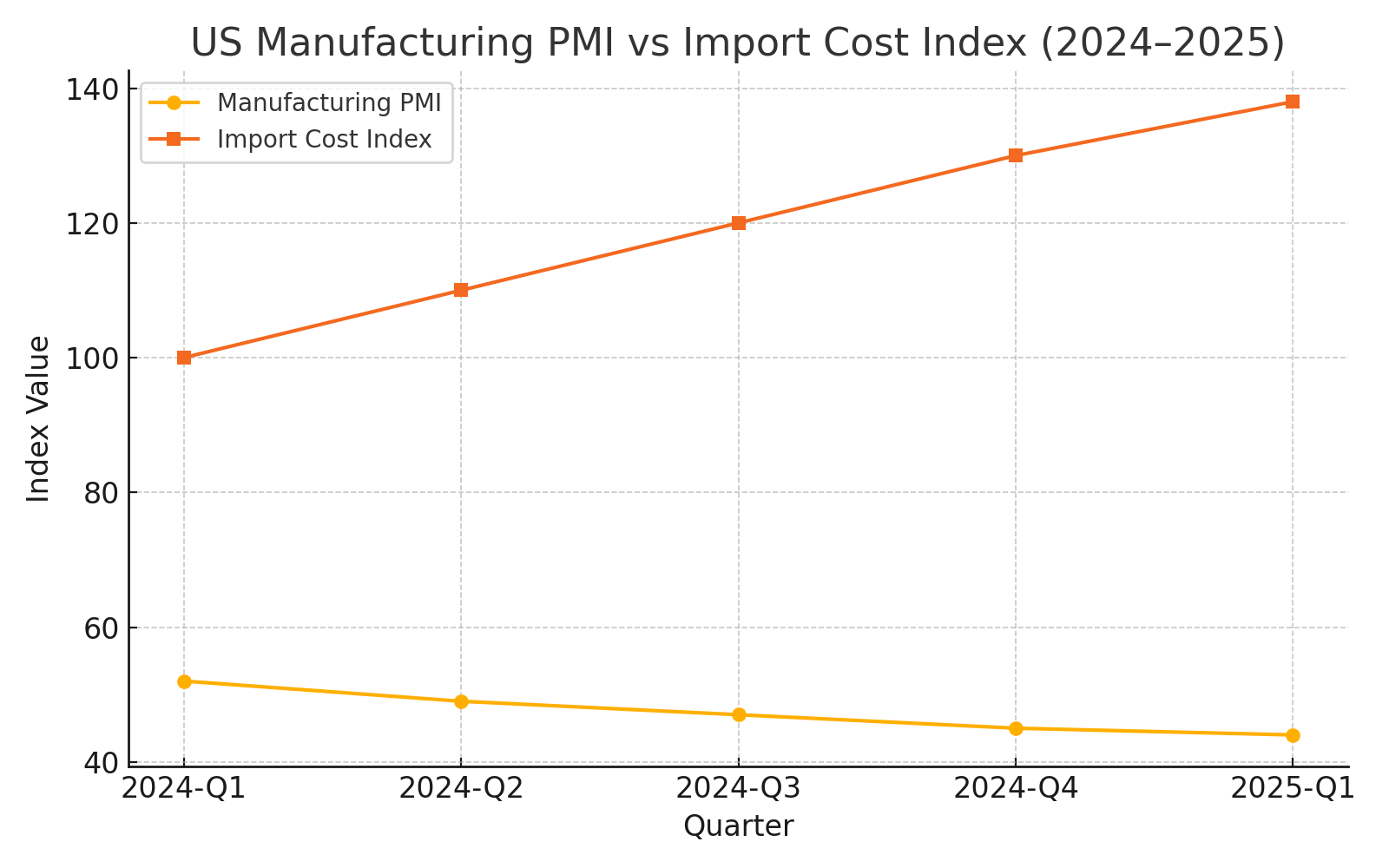

That’s a one-two punch central bankers dread. You can almost hear the word stagflation creeping back into the headlines.

Former NY Fed President Bill Dudley said, “Stagflation might be the best-case scenario.”

Bitvision readers know this story well. In our earlier analysis of Trump’s tariff map (read here), we saw how taxes on industrial parts, fertilizers, and electronics trickled down to everything from groceries to housing materials. The effects weren’t linear. They were systemic.

US Manufacturing PMI vs Import Cost Index (2024–2025)

Will the Fed hike rates again?

It’s tricky. Raising interest rates too fast could cool inflation—but risk triggering a recession. Doing nothing? Inflation expectations may “unanchor,” forcing the Fed to slam the brakes later.

It’s a high-wire act. And tariffs just shook the rope.

Consumers already feel it.

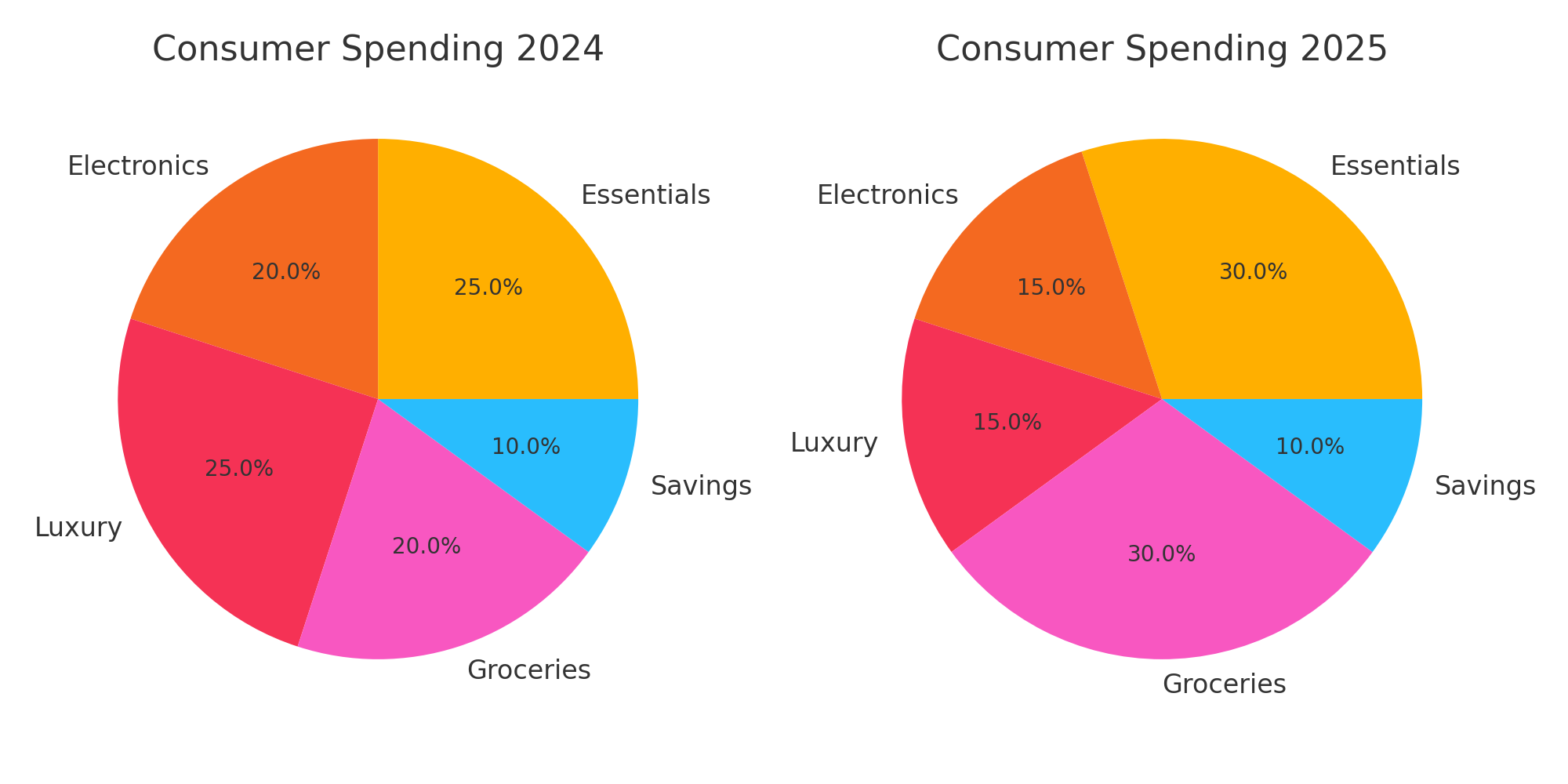

People are shifting behavior. Retailers report stockpiling. More Americans are buying in bulk. Luxury spending is down. Even big box stores are adjusting inventories.

Changes in Consumer Spending Patterns (2024 vs 2025)

The global stage reacts.

Countries hit by US tariffs are preparing retaliatory strikes. China, Vietnam, and India are considering tariffs on American agricultural goods and industrial exports. It’s not just a US issue anymore.

So what now?

The Fed is walking a narrow path, and tariffs have steeped the trail. For investors, policymakers, and citizens, the message is clear:

Inflation isn’t gone. It may have just changed costumes.

Stay informed. Stay nimble.

Because prices were the first casualty in this tariff war.