Something snapped in global investor sentiment—and the numbers don’t lie.

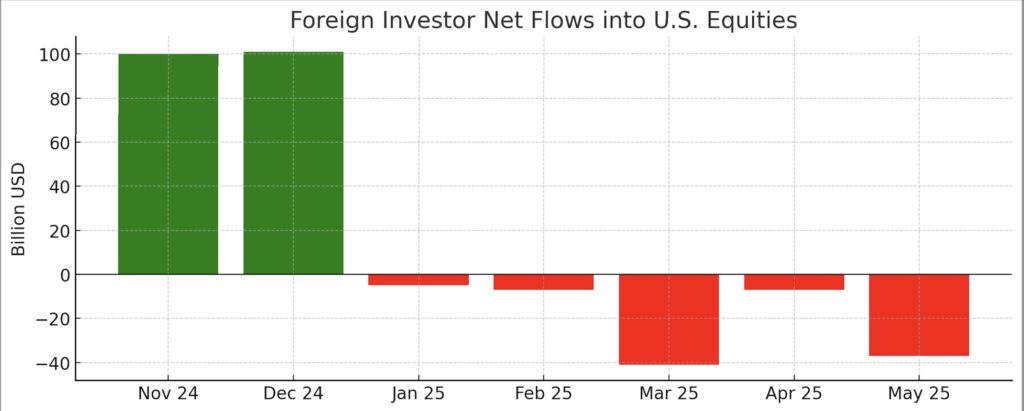

After pouring over $201 billion into U.S. equities during the November and December 2024 rally, foreign investors have now reversed course hard, pulling $44 billion out in just two months.

Even more shocking? This outflow happened while U.S. stock indices were still rising.

This investment flows out isn’t just a blip. It’s a global mood shift.

👇 Here’s why foreign money is breaking up with America’s markets.

1. Foreign Love for U.S. Stocks? Gone.

In April, net foreign outflows hit $7 billion.

That number exploded to $37 billion in May—the largest monthly net withdrawal in over a year.

This marks a clear turning point for a market once supported by global capital inflows.

And the selloff may just be getting started.

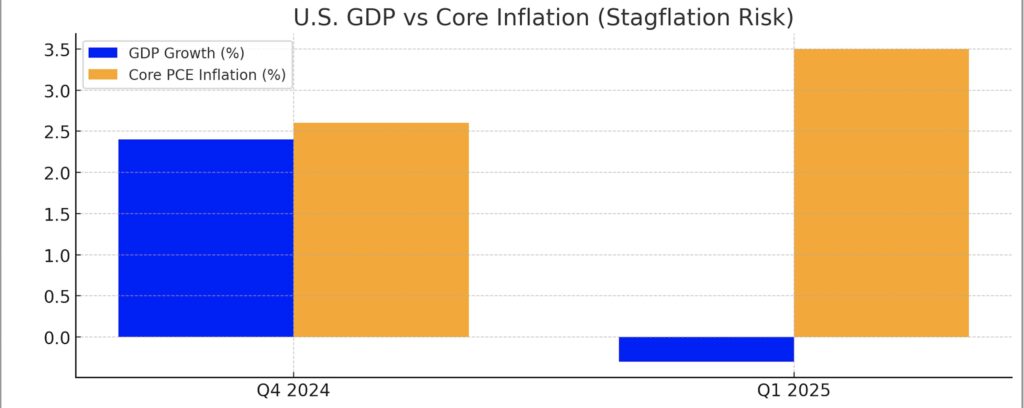

2. Stagflation: The Worst of Both Worlds

GDP fell –0.3% in Q1 2025.

Core inflation rose to 3.5%.

Slowing growth + sticky inflation = the “S” word foreign investors hate: stagflation.

As we highlighted in The Fed’s New Enemy: Sticky Inflation from Tariffs, rising input costs, geopolitical tensions, and tariff-driven price hikes are fueling long-term inflationary pressures even as business activity cools.

With no clear path to rate cuts and earnings forecasts under pressure, global investors are questioning U.S. market resilience.

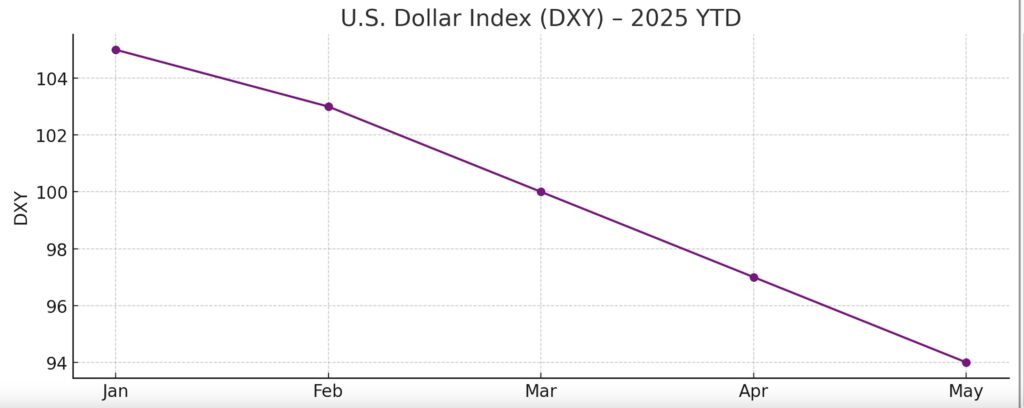

3. The Dollar Isn’t Their Safe Haven Anymore

The U.S. Dollar Index (DXY) is down more than 10% year-to-date.

That’s one of the sharpest slides in recent memory.

For global investors, this means smaller returns once gains are converted back to euros, yen, or yuan. It also skyrockets hedging costs.

Once the dollar stops acting as a safe-haven asset in times of crisis, institutional investors don’t just take notice—they reallocate.

4. Trump’s Tariff Drama = Trust Issues

April started with a bang—President Trump announced sweeping tariffs on allies and rivals alike.

Days later, he paused them for 90 days.

Markets may have recovered, but foreign capital didn’t.

The damage was done.

This kind of political whiplash makes it hard for foreign institutions to stay invested in America. If policy can change overnight, it’s safer to park capital elsewhere.

As one strategist quipped, “Wall Street is up, but trust is down.”

5. Europe and Asia Are Getting All the Attention

Europe is outperforming U.S. markets in dollar and local terms—up 11% year-to-date in euros.

Japan? It’s experiencing its largest monthly inflows, with $57B in new capital in April alone.

Why?

✔️ Lower valuations

✔️ Political stability

✔️ Growing GDP

✔️ Favorable central bank policies

While the U.S. seems expensive and chaotic, global capital is finding more attractive—and calmer—places to grow.

Bonus: FDI Is Dropping Too

It’s not just portfolio money heading out the door.

Foreign direct investment (FDI) into the U.S. is also declining.

That means fewer factories, fewer cross-border M&A deals, and less long-term confidence in the American economy.

📉 Track the numbers here: U.S. FDI – Trading Economics

When capital exits both Wall Street and Main Street, it’s not just about sentiment—it’s about structural change.

💡 Big Picture: The Breakup Is Real

Foreign investors held 18% of U.S. equities at the beginning of 2025.

That exposure is now being trimmed, rotated, and in some cases… dumped.

We’re witnessing a portfolio regime shift:

→ From U.S.-centric to global-diversified.

→ From faith in the Fed to bets on the ECB and BOJ.

→ From Wall Street to the world.

🧠 Final Takeaway:

For years, America was the default trade.

Now? That status is being challenged.

The message from global investors is loud and clear:

“Wall Street, we loved you… but we’ve moved on.”

💔 Don’t call. Don’t text.