By Michelle Tan | BitVision.ai

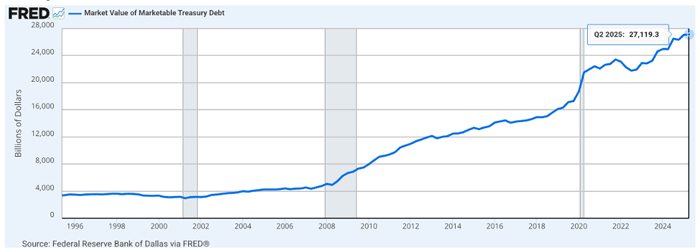

$1.007 trillion.

That’s how much the U.S. Treasury quietly announced it plans to borrow, just for Q3 2025.

Treasury’s action isn’t just another budget headline. It’s the second-largest quarterly debt raise in U.S. history, eclipsed only by the COVID-era panic. By October, the national debt could surge past $28 trillion. In 90 days, the government will have added a full $1 trillion—a nearly 4% jump.

But here’s the twist Wall Street missed: Crypto is no longer the rebel outside the system. It’s now part of the rescue plan.

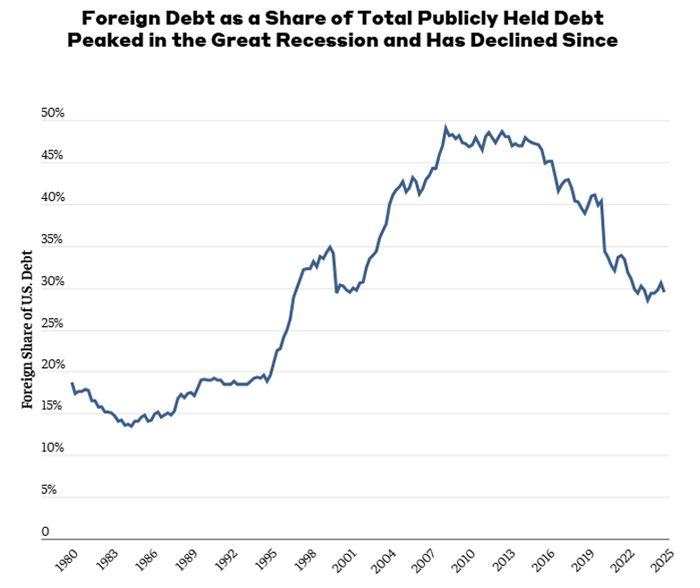

📉 Foreign Buyers Exit, the Treasury Scrambles

Once upon a time, foreign governments held nearly half of all U.S. debt. But times have changed.

- China has dumped over $500 billion in Treasurys over the past decade.

- Japan, while still the top holder, is liquidating assets to defend the yen.

- And today, foreign ownership of U.S. debt has dropped dramatically below 49%.

The U.S. Treasury—led by Secretary Scott Bessent—faces a dilemma: Who’s going to buy all this debt?

The surprising answer: the crypto industry.

Source: U.S. Department of the Treasury, collected by the Federal Reserve Bank of St. Louis

🏛️ A New Financial Engine: Crypto + Treasury = Stablecoin Surge

It started with a legislative catalyst: the GENIUS Act, signed by President Trump in July 2025. The law gives regulatory clarity to U.S. dollar–backed stablecoins—digital tokens pegged 1:1 to the dollar and backed by short-term Treasurys and cash.

Treasury Secretary Bessent said it best:

“This groundbreaking technology will buttress the dollar’s status as the global reserve currency… and lead to a surge in demand for U.S. Treasurys.”

It’s a new financial feedback loop:

- More crypto trading →

- More stablecoins created →

- More Treasurys bought as collateral →

- More debt absorbed without raising rates →

- Mission accomplished.

💡 The CLARITY Act: Turning Crypto into Policy

Coming later this August, the CLARITY Act will land in the Senate. It’s a sweeping regulatory framework that encourages developers, protocols, and Web3 builders to innovate without fear of regulatory whiplash.

This Bill is not the same Washington D.C. that greenlit Operation Chokepoint 2.0 and arrested open-source developers.

It’s a complete reversal—and it’s strategic.

President Trump has filled the deck:

- David Sacks as Crypto Czar

- Paul Atkins is heading the SEC

- Brian Quintenz at the CFTC

- New crypto-aligned finance committee chairs

- And digital asset advisors inside the Treasury

This strategy is a coordinated effort to make the U.S. the crypto capital of the world, with one clear objective: fuel stablecoin adoption to backstop America’s debt.

🪙 Ethereum Leads, Stablecoins Boom

Crypto markets have already started to price this in:

- Ether (ETH) is up 60% in a month.

- Total crypto market cap (excluding stablecoins) is up 20%.

- Stablecoin creation—especially from Tether and Circle—is ramping fast.

Since most stablecoins run on Ethereum, ETH is benefiting first. But it won’t stop there. Every project that powers tokenized dollars, assets, and supply chains is in play.

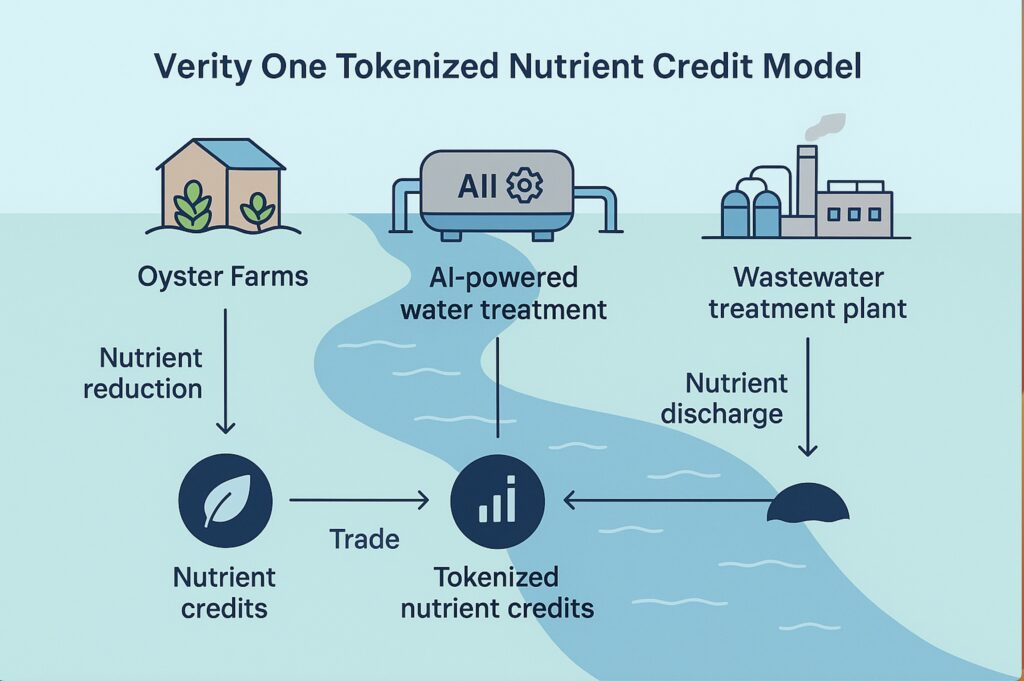

🌐 Real-World Tokenization: Verity. One Enters the Chat

Behind the charts and politics is a deeper revolution: real-world asset tokenization.

Platforms like Verity are tokenizing production, products, and even pollution credits—bringing radical transparency to global trade and environmental sustainability. Using AI, blockchain, and IoT, Verity verifies what matters—from “Made in USA” goods to nutrient credits for clean water.

Their system is turning oysters, crops, and carbon into verifiable tokens that can be traded, taxed, and trusted. Supplychain onchain isn’t the metaverse—it’s the on-chain industrial revolution.

For more on how tokenization is replacing paper trails, read our deep dive: The New Age of Financial Revolution.

📊 The Endgame: A $3.7 Trillion Stablecoin Economy?

Treasury Secretary Bessent sees the writing on the blockchain:

“Stablecoins could grow to $3.7 trillion—a 10x jump from today’s $260 billion market cap.”

If that happens, $3.4 trillion in fresh demand for Treasurys could materialize from crypto alone. That means the government can issue more debt without jacking up interest rates—a soft landing engineered by digital liquidity.

In short, crypto becomes the buyer of last resort.

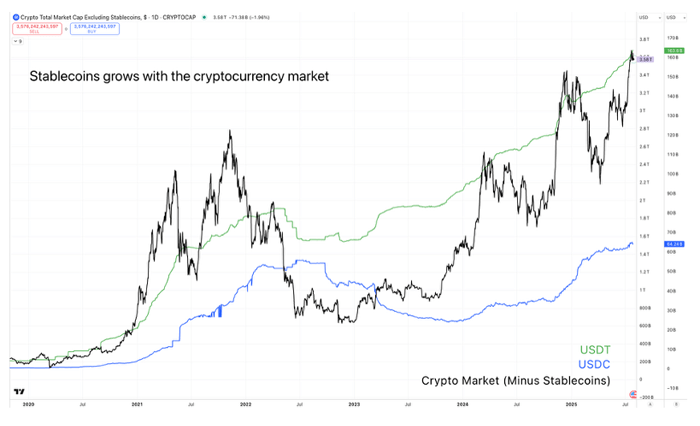

Take a look at the chart below. It shows the total market cap of cryptocurrencies, excluding stablecoins. That’s the black line.

🧠 Final Thoughts: A Quiet Revolution in Plain Sight

Don’t be distracted by the price charts or political headlines.

Look deeper:

- The dollar is quietly embedding itself into Web3.

- The Treasury is partnering with stablecoins, by design.

- And tokenized real-world assets, like those tracked by Verity. One, we are realigning the global economy.

This digital trend isn’t the next bull run.

It’s the beginning of crypto’s sovereign role in modern finance.

BitVision.ai will be tracking this playbook—every vote, protocol, and wallet address that reshapes our financial system.

Stay tuned. The internet of finance is only just beginning.