The crypto industry is entering a decisive phase. For years, launching a blockchain project meant navigating a maze of jurisdictions, maintaining multiple corporate entities, and living under the constant shadow of regulatory risk. Legal ambiguity wasn’t just a startup headache — it was a growth ceiling for the entire sector.

Now, one of the largest decentralized exchanges in the world — Uniswap — is rewriting the rules. Its move to onshore governance and compliance in the United States could signal a broader revaluation wave for digital assets.

From Legal Uncertainty to U.S. Clarity

In late July, SEC Chairman Paul Atkins emphasized that onshoring crypto projects should be a priority. The message was clear: the U.S. wants digital asset innovation within its borders, not scattered across offshore jurisdictions.

Historically, crypto projects were forced to incorporate in fragmented structures:

- Equity company in one jurisdiction.

- Nonprofit foundation in another.

- Development labs elsewhere.

Legal action, causing high legal costs, complex tax obligations, and little real protection from enforcement actions — even for projects acting in good faith. Investors suffered too, with no standardized understanding of token-holder rights.

Uniswap’s answer is DUNI — a Wyoming-based Decentralized Unincorporated Nonprofit Association (DUNA). This entity:

- Can enter into contracts.

- Retain service providers.

- Maintain tax and regulatory compliance.

- Shield governance participants from personal liability.

This DUNA marks the first time a primary DeFi protocol of Uniswap’s scale has brought its DAO governance structure into a U.S.-recognized legal framework.

The Fee Switch That Could Reshape Tokenomics

Beyond governance reform, Uniswap holds another powerful lever — the long-debated “fee switch.”

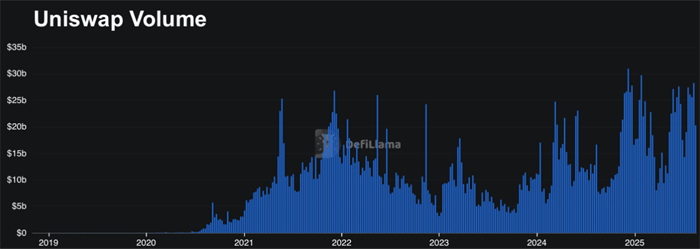

- Since its inception, Uniswap has processed over $3 trillion in volume.

- In the last 30 days alone: $122 billion traded.

- A 0.05% protocol fee could yield ~$732 million annually.

If rewards from this fee are tied to staking, the yield for active stakers could be game-changing:

- At 25% token staking: potential yield of 44.4%.

- This creates a supply shock — fewer tokens circulating means upward price pressure if demand rises.

Compared to the S&P 500’s ~1.25% dividend yield, Uniswap’s potential staking returns could draw significant capital from traditional markets.

Why This Matters for the Broader Market

The CLARITY Act, now slated for a potential vote in late September, could cement these advantages. Passage would:

- Set legal definitions for digital assets.

- Lower compliance friction for DAOs.

- Open the door for institutional liquidity to enter DeFi.

For more on how regulatory shifts drive market repricing, see our analysis in The New Age of Financial Revolution.

Uniswap’s Next Phase: Beyond Ethereum

While Ethereum remains its home base, Uniswap is already deployed across multiple chains — including Arbitrum, Optimism, Polygon, and Base. With its legal foundation secured, expansion could accelerate in three directions:

- Cross-chain liquidity aggregation — capturing market share from smaller DEXs.

- Institutional-grade products — compliant liquidity pools designed for funds and banks.

- AI-agent integration — enabling autonomous trading and liquidity provision without human intermediaries.

BitVision’s Prediction

If the CLARITY Act passes and the fee switch is activated in the next 12 months:

- UNI token price could enter a sustained revaluation phase, with a realistic doubling in market cap within 6–9 months post-announcement.

- Staking participation rates will likely start low (~15%) but could exceed 40% within two years, compressing circulating supply and driving scarcity-driven price gains.

- The DUNI framework will become the template for DAO compliance in the U.S., attracting other top DeFi protocols to Wyoming.

The convergence of legal clarity, tokenomics optimization, and multi-chain expansion puts Uniswap in a rare position — much like early Coinbase, but without the centralized baggage.

Bottom line:

Uniswap’s governance onshoring is more than a compliance maneuver — it’s a strategic market signal. In an industry where regulation often means restriction, this is the opposite: a legal unlock that could fuel the next great crypto repricing cycle.

With plenty more events lined up this year, make sure you’re following us on X/Twitter and joining the conversation in Michelle’s Linkedin to stay in the loop. We’re just getting started, and we’d love to see you at the next one.