A Historic Seizure

The U.S. Department of Justice has executed the largest cryptocurrency forfeiture in American history—seizing 127,271 Bitcoin, worth approximately $15 billion, from wallets linked to an elaborate “pig butchering” scam ring operating out of Cambodia.

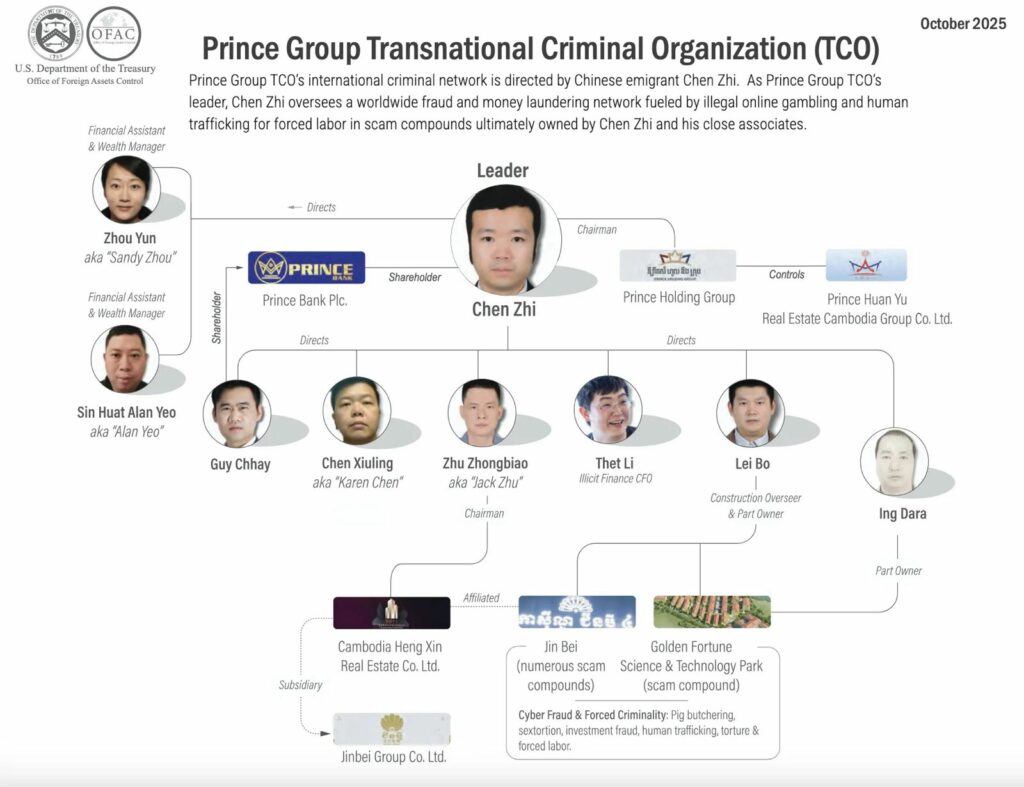

The alleged mastermind, Chen Zhi (also known as “Vincent”), founder and chairman of Prince Holding Group, now stands accused of running one of Asia’s most sophisticated transnational criminal enterprises under the facade of a legitimate multinational conglomerate.

The indictment, unsealed in Brooklyn federal court, reveals that Zhi’s network exploited social media, dating apps, and encrypted messaging platforms to defraud victims globally—while simultaneously operating forced-labor compounds that trafficked and enslaved workers to execute these scams.

What Is “Pig Butchering”?

“Pig butchering” (sha zhu pan) is a chillingly apt metaphor used by law enforcement to describe scams in which fraudsters “fatten” victims over time—building trust, romance, or friendship—before leading them to financial slaughter.

The scammers, often posing as investors or romantic interests, convince targets to transfer crypto to fake investment platforms that promise astronomical returns. Once funds are sent, they vanish into blockchain-obscured accounts—never to be recovered.

But in this case, prosecutors allege something far darker: the people running the scams weren’t just criminals—they were victims of human trafficking, beaten and enslaved in Zhi’s compounds across Cambodia, Myanmar, and Laos.

Behind the Facade: Prince Holding Group’s Dual Reality

On paper, Prince Holding Group appeared to be a fast-rising Cambodian conglomerate, involved in real estate, banking, and consumer goods. In reality, prosecutors claim it evolved “in secret into one of Asia’s largest transnational criminal organizations.”

Investigators say Chen Zhi and his senior executives used political influence, bribes, and offshore banking channels to protect the operation from scrutiny. The organization allegedly maintained ties across China, Hong Kong, Singapore, and the Middle East—masking illegal operations through legitimate subsidiaries.

Daily crypto inflows from victims reached an estimated $30 million, according to U.S. prosecutors, funneling through unhosted wallets, OTC brokers, and high-volume trading accounts to obfuscate origins.

The DOJ’s Record-Breaking Action

“This is the largest cryptocurrency forfeiture action in the Department’s history,” said Breon Peace, U.S. Attorney for the Eastern District of New York.

Blockchain forensic analysts traced the coins through layers of shell corporations and obfuscated mixers before identifying wallet clusters tied to Prince Group. Much of the seized crypto had been moved through Iranian and Chinese mining operations, according to forensic firm Elliptic, revealing links between crypto crime, energy markets, and illicit finance.

Crypto’s Dark Mirror

This seizure exposes a critical paradox in the blockchain world.

While crypto promises transparency and decentralization, it also enables borderless anonymity that empowers organized crime. Unhosted wallets, OTC brokers, and privacy coins have become the digital underworld’s favorite tools.

The Zhi case demonstrates how illicit finance ecosystems can mimic legitimate corporate structures, creating an illusion of respectability while orchestrating billion-dollar fraud.

Yet it also shows the power of blockchain transparency: the very ledger designed to anonymize transactions ultimately provided the trail that led investigators straight to Zhi’s empire.

Human Cost: The Forgotten Victims

Beneath the headlines lies an even more tragic layer. Thousands of young workers were reportedly lured with promises of tech jobs, only to be trafficked, beaten, or held hostage in “scam compounds.”

Testimonies describe victims chained, electrocuted, or starved for failing to meet crypto extortion quotas. The United Nations has identified Cambodia and Myanmar as hotspots for these digital slavery operations—a new hybrid of cybercrime and human trafficking that thrives in regions with weak governance and strong connectivity.

Global Fallout & Policy Implications

The $15 billion seizure is more than a legal victory—it’s a geopolitical message.

- Regulatory Momentum: Expect Western regulators to intensify pressure on crypto exchanges to monitor cross-border flows and flag illicit transactions more aggressively.

- Human Rights Front: The case will likely accelerate calls for international task forces against cyber-slavery, expanding the narrative from “financial crime” to humanitarian crisis.

- Diplomatic Repercussions: Cambodia’s alignment with Chinese influence—and its tolerance for such compounds—may face scrutiny from the U.S. and UK, both of which have now issued coordinated sanctions on Prince Group entities.

- Crypto Markets Impact: While Bitcoin’s price has remained relatively stable, this incident reignites debate over traceability versus privacy, and whether DeFi protocols should integrate crime-detection layers by design.

What Comes Next

Chen Zhi remains at large. Interpol has been alerted, and the U.S. is expected to seek extradition. But the real question now is what happens to the seized assets—and whether victims will ever see restitution.

The DOJ has indicated plans to convert part of the seized Bitcoin to fiat for safekeeping, a process that could influence short-term liquidity in crypto markets. Meanwhile, legal analysts expect a protracted battle over asset ownership, as multiple countries stake claims tied to victim restitution.

BitVision Insight: A Turning Point for Crypto Justice

This case is not merely about crime—it’s about evolution. The intersection of crypto, human trafficking, and state-enabled corruption is becoming the new frontier of financial enforcement.

What began as a $15 billion fraud story may become the foundation of a global anti-scam framework uniting blockchain analytics, diplomacy, and AI-driven investigation.

For now, it stands as a stark reminder:

In the borderless world of crypto, transparency cuts both ways. The same technology that enables deception can also deliver justice.