This week, the crypto market stumbled. Prices dipped. Fear surged. The media ran wild.

But let’s set the record straight:

This crash isn’t the end. It’s the beginning—for savvy investors.

⚔️ Geopolitics, Hacks, and Hype—The Real Reasons Behind the Drop

- 🔥 War Moves Markets

- The Israel-Iran conflict is escalating. As missiles fly, the capital flees. Risk assets like Crypto are the first to flinch. However, these geopolitical tremors rarely cause lasting damage to the blockchain economy.

- 🚨 BREAKING: Iran’s Nobitex Hacked for $90M+

- In a politically charged cyberattack, pro-Israel hackers drained Iran’s largest crypto exchange, Nobitex, sending shockwaves across global DeFi. The group “Predatory Sparrow” claimed responsibility—and even threatened to leak the source code. It’s a wake-up call for security.

- 📉 Post-Rally Hangover

- After the U.S. Senate passed the GENIUS Act, Circle’s stock exploded. Stablecoin confidence soared. But when profits hit fast, traders lock them in even quicker. This correction? It’s normal.

- 🤖 ETF Hype, AI Buzz, and Rate Fog

- Bitcoin ETFs brought in new buyers, but expectations overheated. Meanwhile, macro uncertainty—especially on rate cuts and inflation—weighs on every sector, including Crypto.

@DefiFinace twitter

🧭 What the GENIUS Act Means

Let’s zoom in:

Congress just passed the first major crypto law in U.S. history.

The GENIUS Act provides a federal framework for stablecoins, opening the floodgates for banks, fintechs, and institutions to tokenize real-world assets (RWAs).

There are no small steps. It’s the green light Wall Street was waiting for.

Winners to watch:

- Circle (USDC)

- Coinbase (COIN)

- Ripple & Hedera — both with deep RWA infrastructure

- AI + Crypto ecosystems like Bittensor, Gensyn, and Verity One (tracking ESG & KYC data on-chain)

Want to understand how RWA is reshaping the future? Check our breakdown of blockchain’s real growth story in 2025.

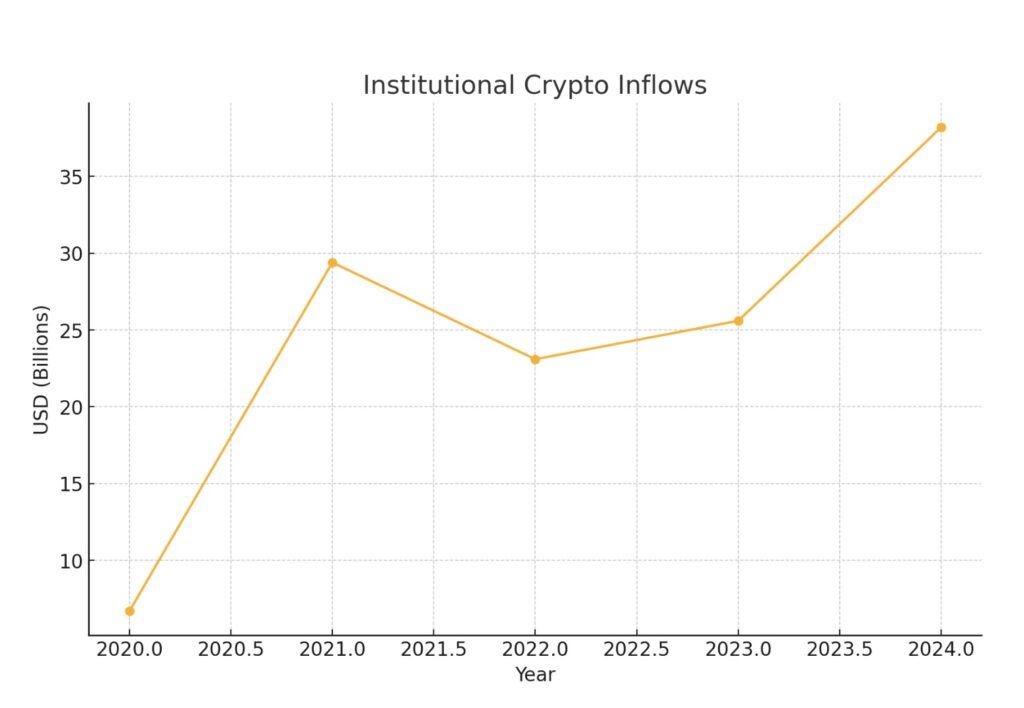

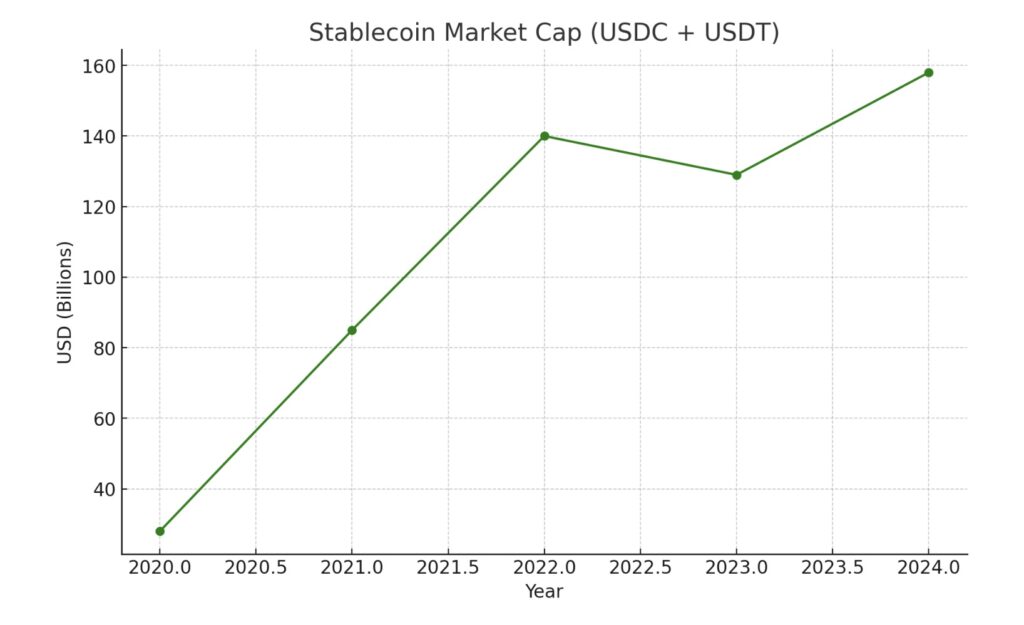

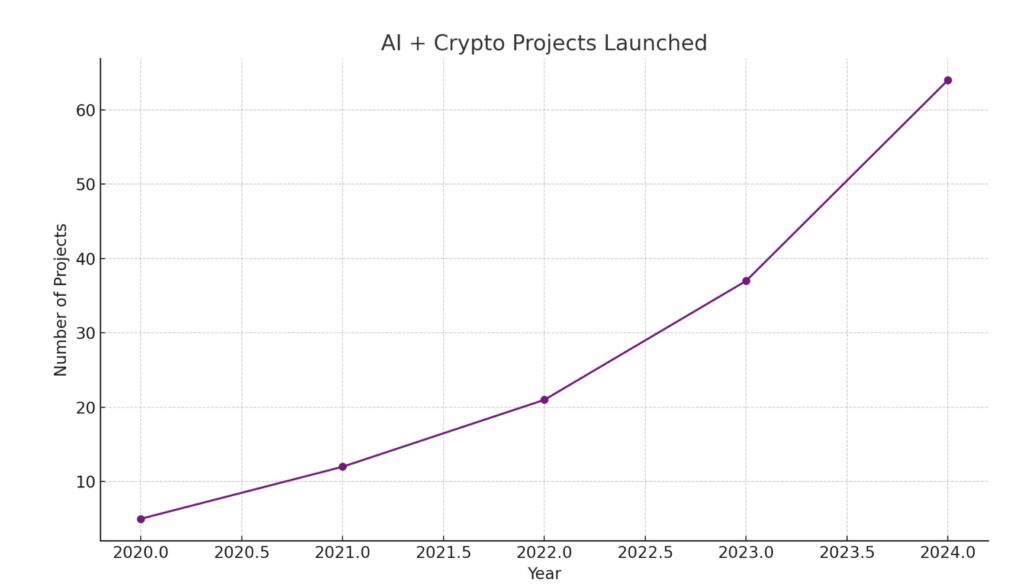

📊 Let the Charts Talk

📈 Institutional inflows in 2024 have topped $38 billion,

📊 Stablecoin market cap? Up to $158B, led by USDC and USDT.

🤖 AI + crypto projects have more than 10x’ed since 2020.

The data is screaming:

The builders never stopped. The market just blinked.

💡 What Investors Should Do Now

Don’t sell the fear. Buy the fundamentals.

Use this dip to position in:

- Protocols with utility and compliance (XRP, HBAR, TAO)

- Exchanges and platforms aligned with U.S. regulation

- Infrastructure tokens enabling AI, identity, and asset tokenization

Don’t just chase memes. Bet on projects that solve problems.

🧘♀️ Final Word: Crypto Isn’t Crashing. It’s Clearing the Path.

Yes, volatility hurts. But panic never pays.

This market isn’t a breakdown. It’s a buildup—for those who stay patient.

So, while the headlines scream…

You? Stay sharp. Stay curious. And when the smoke clears—own the future.