By Michelle Tan, BitVision.ai

June 2025

Sixteen years after Bitcoin first challenged the status quo, crypto is no longer the rebel—it’s the architect of a new financial reality.

From Wall Street to Main Street and Fortune 500 boardrooms to solo entrepreneurs, one thing is clear: the on-chain era has begun. But here’s the twist—it’s still early—very early.

Let’s break down what this means for you.

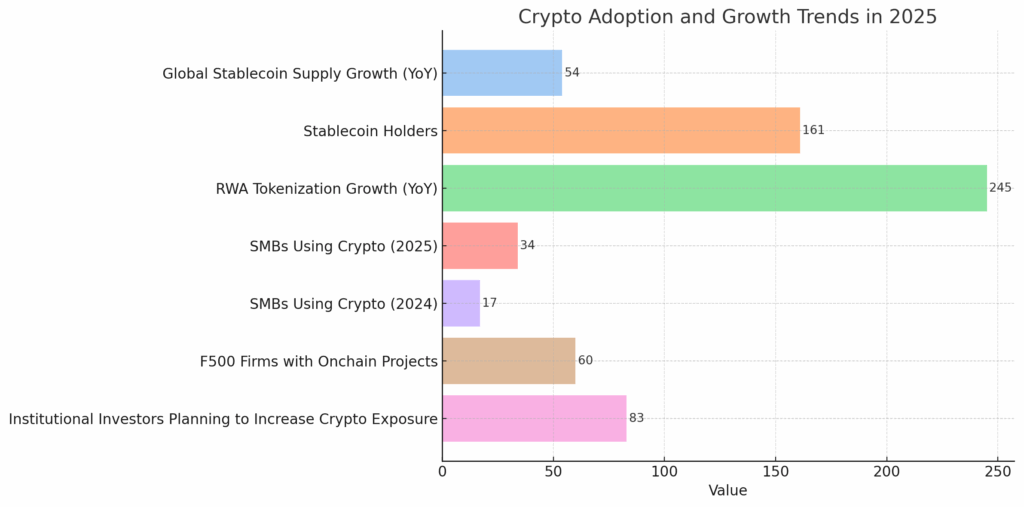

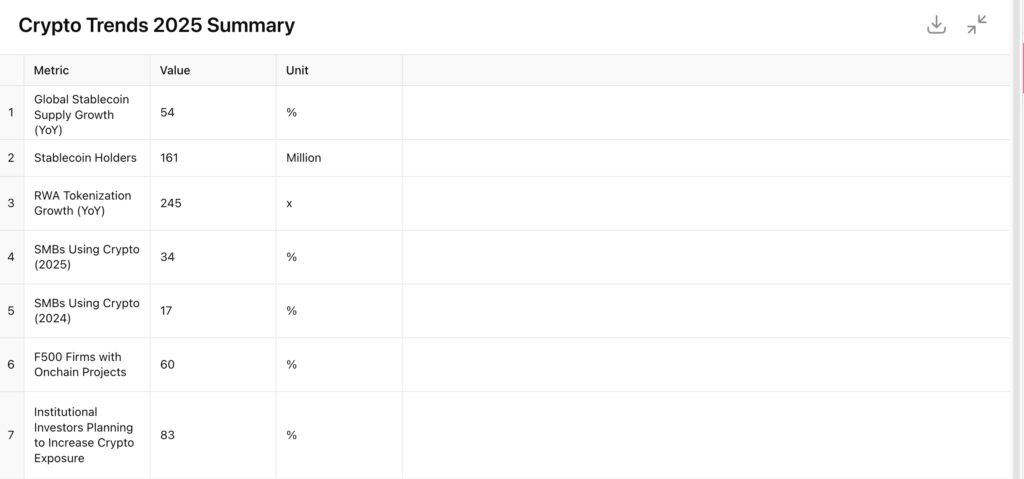

📊 The Numbers Don’t Lie: Crypto Adoption Is Exploding

According to Coinbase’s latest State of Crypto report:

- 🔄 Stablecoin supply grew 54% year-over-year, hitting $247B in May 2025.

- 👥 There are now 161 million stablecoin holders—more than the population of Japan.

- 🏢 60% of Fortune 500 companies are building onchain.

- 📈 Real-world asset tokenization? Up 245x in 5 years. That’s not a typo.

- 🏪 One in three SMBs use crypto. That’s double from last year.

- 💼 83% of institutional investors plan to boost their crypto exposure in 2025.

Crypto is no longer hype. This adoption is history.

🏛️ Global Blockchain Business Council in DC: A Front Row Seat

Earlier this month, I attended the Global Blockchain Business Council (GBBC) event in Washington, DC. Here, regulation met innovation, and global blockchain leaders gathered to shape what comes next.

🎥 Watch my YouTube recap here :

The conversations were powerful. From AI and tokenization to real-world use cases, it’s clear the future is already in motion—and being decided now.

🏗️ Fortune 500 Is Going Onchain (And You Should Pay Attention)

Nearly half of Fortune 500 execs say their crypto investment has grown this year. Use cases are evolving fast—from payments and cross-border transfers to supply chain and identity management.

🔮 What does that mean for investors?

Onchain tech is now a corporate imperative, not an experiment. We’re entering the phase where blockchain became as standard as email in the 2000s.

Translation: Follow the builders—not just the token price.

🧾 Real-World Assets (RWAs): The Billion-Dollar Shift You Can’t-Miss

RWAs are the bridge between DeFi and tangible value. We’re talking about tokenized:

- U.S. Treasuries

- Private credit

- Invoices

- Commodities

From just $85M in 2020 to over $21B in 2025, RWAs are attracting serious institutional capital. Projects like Figure, BUIDL, and BENJI are leading, but retail investors—yes, you—now have access to them.

💡Pro tip: Watch RWA protocols. RWA protocol is where utility meets yield.

💵 Stablecoins: The Dollar’s Digital Avatar

Stablecoins aren’t just for crypto nerds anymore. They’re solving real-world problems:

- ✈️ Cheaper remittances

- 💳 Lower merchant fees

- 🌎 Faster payroll across borders

- 🔐 Financial access for the unbanked

And guess what? Circle and Tether now hold more U.S. Treasury bills than Germany.

Let that sink in.

🇺🇸 When Politics Meets Crypto: Trump’s Bitcoin Bet

Political power players are staking their claims as blockchain moves into the spotlight. Earlier this year, I dove into Trump’s bold $24 million Bitcoin mining venture through ABTC, a company positioning crypto as the new economic flag of America. If you missed it, catch up here:

📖 Bitcoin Is the Flag Now: Inside Trump’s $24M ABTC Gambit

Crypto isn’t just a market story anymore—it’s a political one, too.

🏦 Institutional Money Is Flowing In—Finally

The ETF floodgates opened in 2024. Since then:

- The top 10 Bitcoin ETFs saw $50B in inflows.

- Ethereum ETFs broke records, too.

- Retail still dominates volume, but institutions are rapidly catching up.

And this year?

- 84% of institutions want to use stablecoins.

- 76% plan to invest in tokenized assets by 2026.

If you’ve ever wondered when the pros would arrive—they’re here.

- This comprehensive analysis examines how enterprises are leveraging stablecoins to address real-world frictions in global finance and highlights key barriers that must be overcome for stablecoins to achieve mainstream adoption.

- This research report is published in collaboration with Coinbase.

- The full PDF version of this report is accessible here.

🛑 But One Big Thing Is Still Missing: Regulation

The elephant in the room?

Regulatory clarity.

- 90% of Fortune 500 execs say it’s essential for innovation.

- 72% of SMBs say they’d use crypto if rules were more straightforward.

- Even 3 in 5 investors see regulation as the next growth catalyst.

Without it, the U.S. risks losing talent and innovation to places like the UAE, Singapore, and Europe.

It’s time for Washington to wake up.

🌎 The Takeaway: We’re Still Early—But Not For Long

Crypto is no longer a side bet. It’s becoming the backbone of modern finance.

So, dear investor:

- Diversify.

- Educate yourself.

- Watch the builders.

- Ignore the noise.

The future of money is here. And it’s just begun.

Don’t be the one who looks back and says,

“I wish I’d paid attention in 2025.”

🔔 Subscribe to BitVision.ai for exclusive insights and updates on blockchain, AI, tokenization, and real-world adoption.

Can I now turn this into a social teaser or a video script?