Congress Just Rewired the Future of Finance

By Michelle Tan | July 20, 2025 | BitVision.ai

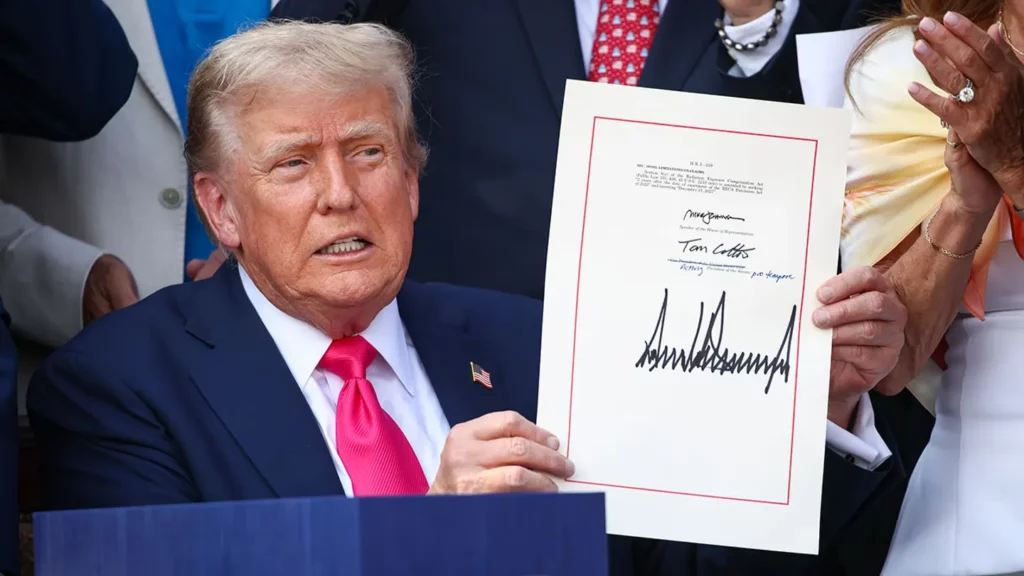

In a dramatic nine-hour session behind closed doors—punctuated by a final phone call from President Donald J. Trump—Congress passed a trio of sweeping financial bills that promise to redefine the landscape of digital money in the United States.

Together, the GENIUS Act, the CLARITY Act, and the Anti-CBDC Surveillance Act form a robust new legal foundation for how Americans create, use, and trade digital assets. These laws aren’t just about crypto—they’re about control, competition, and the currency of the future.

🧠 The GENIUS Act: Making Stablecoins Legit

Long viewed with skepticism, stablecoins have been the underregulated cousin of crypto. The Guaranteed Essential National Infrastructure for US-Dollar Stablecoins Act—better known as the GENIUS Act—changes that.

Following the collapse of FTX, Terra, and Silicon Valley Bank, the Act introduces rigorous standards to restore trust and protect users.

What the GENIUS Act does:

- Requires full reserve backing for every stablecoin

- Enforces independent, recurring audits

- Empowers both federal and state regulators to supervise issuers

The law introduces two classes of issuers:

• Federally insured banks, and

• Nonbank institutions (including fintechs and retailers like PayPal or Walmart), which can now enter the stablecoin game if they meet specific capital and risk thresholds.

However, the real genius may lie in geopolitics. By giving U.S. firms the green light to issue dollar-backed stablecoins, the Act arms America with soft power payment rails that could outcompete China’s Digital Yuan, UnionPay, and Belt & Road fintech platforms, especially in emerging markets.

📘 For the official government breakdown, see the White House release:

🔍 The CLARITY Act: Finally, Regulatory Lines in the Sand

The CLARITY Act delivers what entrepreneurs and investors have been demanding for years: a clear distinction between securities and commodities in the crypto space.

Here’s what it changes:

- Initial token offerings stay under SEC oversight.

- Mature, decentralized tokens—such as Bitcoin and Ethereum—will shift to CFTC supervision.

- After issuance, tokens can be freely traded peer-to-peer, like swapping baseball cards, without triggering new regulatory scrutiny.

This new standard opens up secondary markets, empowers tokenized real estate and assets, and breathes life into decentralized finance platforms that had been frozen in legal limbo.

More importantly, it reduces uncertainty, allowing innovators to build and investors to participate without fear of retroactive punishment.

🚫 The Anti-CBDC Surveillance Act: No to OrwellCoin

The third bill—the Anti-CBDC Surveillance Act—prevents the Federal Reserve from issuing a Central Bank Digital Currency.

While Fed-backed digital dollar pilots were quietly underway in collaboration with MIT and private partners, the new law draws a hard line:

- No programmable Fed money

- No expiration-date dollars

- No wallet surveillance by default

The bill doesn’t just ban the Fed from issuing a CBDC. It also protects self-custody rights, affirming that U.S. citizens have the right to hold and manage their digital assets independently, without the need for intermediaries or wallet restrictions.

This ACT sets a vital precedent: crypto is not just speculative—it’s property, with constitutional protection.

💼 Why Now? And Why So Fast?

These bills didn’t pass because Congress suddenly developed an interest in crypto. They passed because the digital asset industry got organized, backed by sharper lobbying, growing voter support, and real geopolitical stakes.

President Trump sees this as a triple win:

- Reining in the Fed,

- Outmaneuvering China, and

- Empowering U.S. entrepreneurs.

The spirit behind these bills mirrors the strategic intent of the One Big Beautiful Bill, which restructured tax incentives and manufacturing policy to favor domestic innovation.

📎 Related: Who Is the Biggest Winner in the One Big Beautiful Bill Act?

🔑 What It All Means

Together, these three bills are the most consequential crypto legislation in U.S. history. Here’s how they break down:

- 🧠 GENIUS Act – Elevates stablecoins to the level of legitimate financial instruments

- 🔍 CLARITY Act – Ends SEC/CFTC confusion and unlocks peer-to-peer trading

- 🚫 Anti-CBDC Act – Blocks government surveillance money and protects self-custody

Whether you’re a builder, investor, or policymaker, the message is clear:

The U.S. is choosing open markets over state control. Innovation over inertia. Digital freedom over digital fiat.

The rules of money have changed.

And the world is watching.