A $5 Trillion Race Investors Can No Longer Ignore

Thirty days ago, artificial intelligence was still discussed as a future.

Then something changed.

Not quietly. Not gradually.

But decisively.

In a single month, conversations turned into contracts, ambition turned into infrastructure, and budgets that once sounded extreme suddenly became insufficient.

This wasn’t hype.

It was the balance sheets moving.

And for investors watching closely, it marked the moment AI crossed from the technology cycle into an industrial supercycle.

From Ideas to Irreversible Commitments

For years, the AI narrative revolved around models, breakthroughs, and theoretical timelines to artificial general intelligence (AGI).

But markets don’t price ideas.

They price capital allocation.

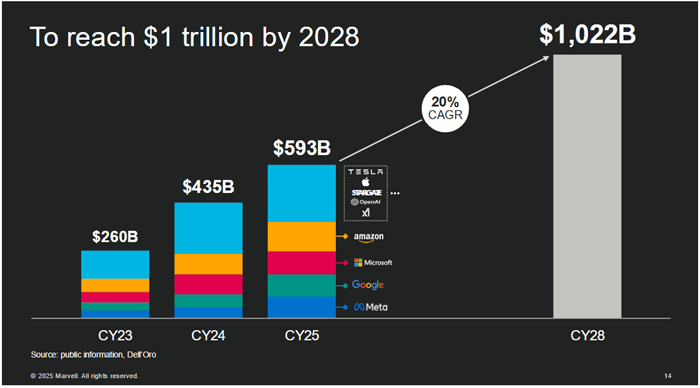

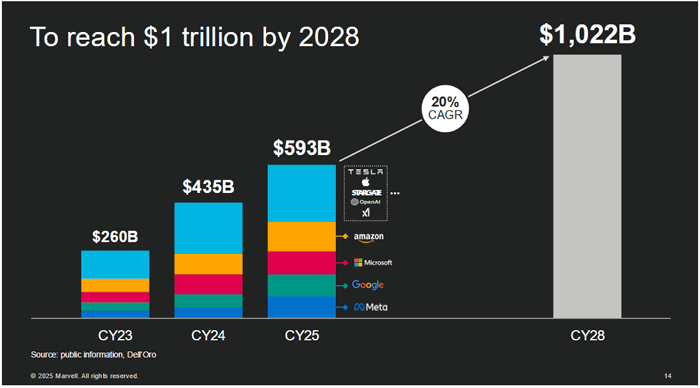

In September alone, nearly $1 trillion in AI-related infrastructure projects, compute agreements, and investments were announced globally.

This wasn’t venture capital.

This was sovereign-scale spending.

Budgets leapt:

- from billions

- to tens of billions

- to hundreds of billions

And once capital commits at this scale, reversal is no longer an option.

Stargate: The Blueprint for the AI Industrial Age

The clearest signal came from the alignment of three forces:

- OpenAI – the world’s most advanced AI model builder

- Oracle – a hyperscale cloud and infrastructure operator

- SoftBank – capital with a long-term strategic mandate

Together, they announced five new U.S. AI data-center sites under the Stargate initiative.

Stargate alone now points toward $500 billion in total investment.

This is not experimental infrastructure.

This is foundational.

When the Builders, the Chips, and the Cloud All Say “Yes”

The significance goes deeper.

Alongside Stargate:

- OpenAI signed a $300B multi-year compute contract with Oracle.

- NVIDIA committed roughly $100B in strategic investment exposure tied to OpenAI’s growth

- CoreWeave and Nebius announced $45B in GPU purchase agreements.

- Governments joined in, including a $42B U.S. AI technology pact.

When:

- the dominant model developer

- the dominant GPU supplier

- and hyperscale cloud providers

Align their balance sheets simultaneously, and the message to the market is unambiguous:

It will be built—regardless of cost.

The GPU Arms Race Goes Public

Then came the numbers that made investors pause.

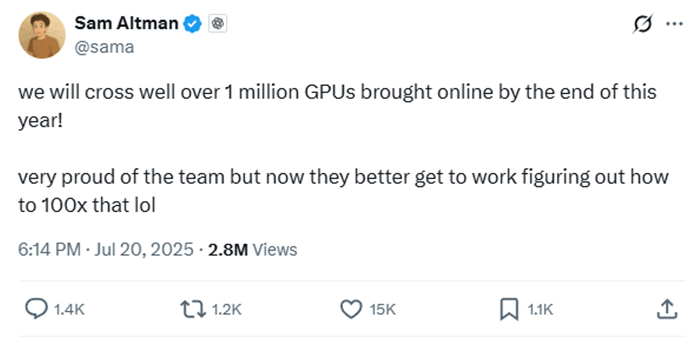

OpenAI CEO Sam Altman publicly stated that the Company will have over 1 million GPUs online by year-end.

That figure alone would have been unthinkable just two years ago.

But Altman didn’t stop there.

He made clear the ambition is to scale 100x beyond that level.

Shortly after, Elon Musk echoed a similar vision, reinforcing that the competition for AI dominance is no longer theoretical.

Meanwhile, xAI’s Colossus 2 project—launched in March 2025—has already assembled infrastructure capable of supporting over 110,000 NVIDIA GB200 server racks, according to SemiAnalysis.

For context:

- Comparable capacity took Oracle, Crusoe, and OpenAI 15+ months to assemble.

- xAI achieved it in a fraction of the time

The speed of deployment is accelerating—and projections are already lagging reality.

The Math of Artificial Superintelligence

Strip away the headlines, and the investment case becomes brutally simple.

Using Stargate’s cost structure:

- 1 GW ≈ $50B

- Estimated compute needed for ASI: ~100 GW

- Implied build cost at today’s prices: ~$5 trillion

Even allowing for:

- improved GPU efficiency

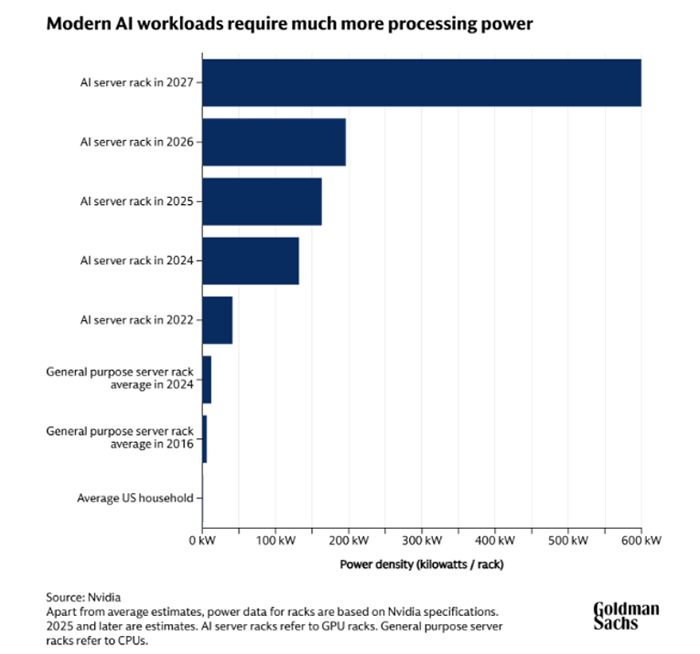

- Higher power density per rack

- better cooling and networking

The conclusion barely changes.

Next-generation ASI-scale clusters could still cost $500B each.

And there will not be just one.

Multiple companies—and multiple nation-states—will build their own clusters to avoid strategic dependence on a single intelligence system. Read more here.

Why Efficiency Doesn’t Slow Spending—It Accelerates It

One of the most misunderstood dynamics in AI investing is efficiency.

Each GPU generation:

- delivers more compute per watt

- increases rack power density

- lowers the cost per unit of intelligence

But instead of reducing spending, efficiency:

- increases returns on scale

- justifies larger clusters

- makes bigger builds economically rational

Even small gains in performance-per-watt translate into hundreds of millions of dollars in electricity savings at a multi-gigawatt scale.

The result?

- Faster upgrade cycles

- Continuous demand for frontier GPUs

- Relentless capital deployment

This Is Bigger Than the Internet—Economically

The personal computer amplified productivity.

The internet connected people.

Smartphones mobilized information.

Artificial superintelligence replaces cognitive labor itself.

That distinction matters.

ASI:

- compounds its own value

- becomes a strategic national asset

- reshapes defense, finance, healthcare, and governance

That is why:

- Governments are committing capital.

- Power contracts are long-dated.

- Supply chains are being locked years in advance.

This is not a software upgrade.

It is an economic re-architecture.

Who Captures the Upside

For investors, the winners are not abstract “AI companies.”

They are constraint owners.

- NVIDIA (NVDA) – dominant frontier compute supplier

- AMD (AMD) – second-source leverage and competition

- TSMC (TSM) – irreplaceable advanced-node manufacturing

- ASML (ASML) – absolute lithography bottleneck

- Micron (MU) – memory bandwidth becomes mission-critical

This is not a short-term trade.

It is a decade-long cycle of infrastructure capture.

Final Thought for Investors

The AI buildout has shifted:

- from multi-megawatt experiments

- to multi-gigawatt industrial systems

- backed by trillions in committed capital

Most of these projects are already:

- financed

- powered

- contracted

Nothing meaningful will slow this race until ASI is achieved.

The market is still pricing AI as a growth theme.

In reality, it has already become critical infrastructure.

And critical infrastructure cycles do not peak early.