In 1882, Thomas Edison switched on America’s first commercial power station in New York City.

Back then, nobody imagined how electricity would reshape civilization.

The press mocked it. Investors hesitated. Politicians dismissed it.

But that single spark triggered:

- industrial automation

- urban expansion

- telecommunications

- computing

- and generations of extraordinary wealth creation

Electricity didn’t just light up cities — it rewired the world.

Today, we are witnessing a similar turning point.

This time, the grid will not only carry power.

It will carry intelligence.

The world is racing toward an “AI Edison Moment” —

the point where artificial intelligence reaches human-level reasoning, then surpasses it.

And just as in 1882, investors are standing on the edge of a century-defining energy revolution.

AI’s Inflection Point Has One Giant Bottleneck: Electricity

Everyone talks about chips, GPUs, and neural networks.

But ask the insiders building AGI systems, and they’ll tell you something different:

The future of AI depends on energy — not code.

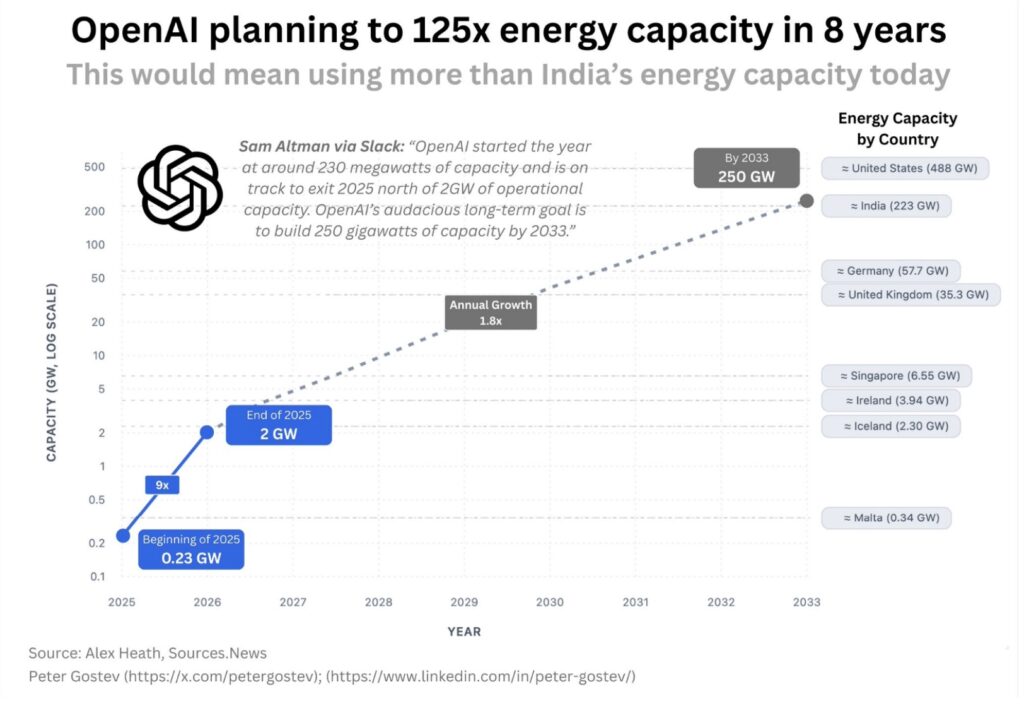

Global data center demand is exploding.

Power needs for AI training clusters are projected to multiply at a shocking speed —

measured not in megawatts, but in gigawatts.

Top AI companies are already planning private power pipelines capable of supplying entire city equivalents of electricity.

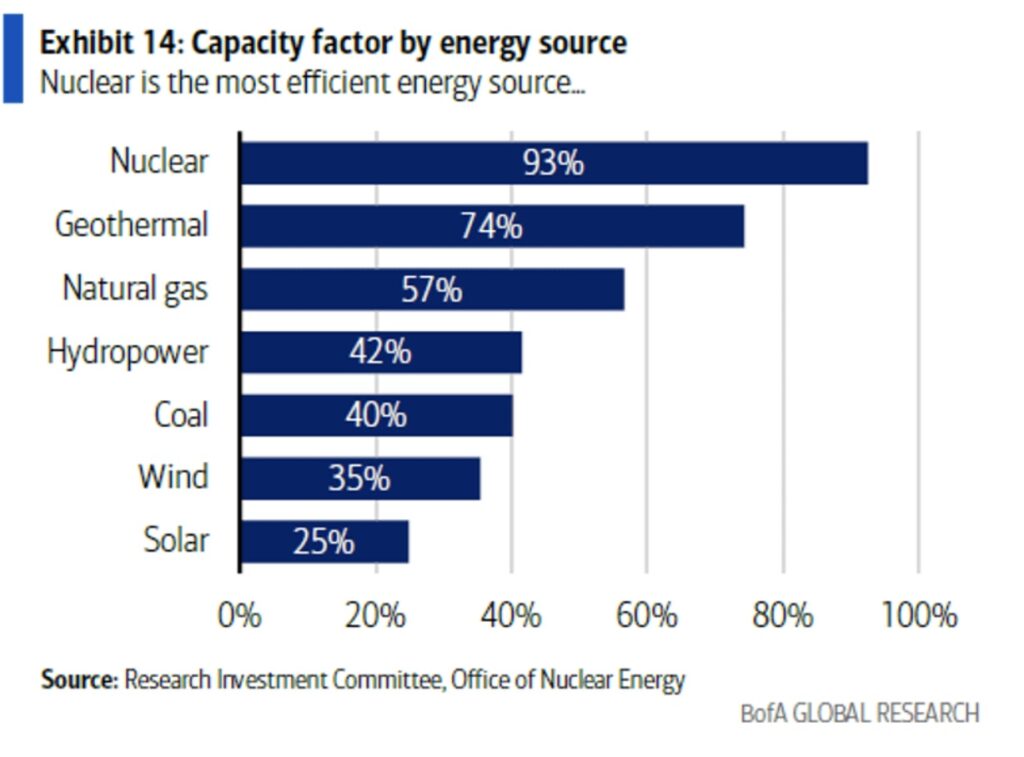

Solar can’t deliver that 24/7.

Wind cannot concentrate output at that density.

Coal and gas cannot scale fast enough, and they carry carbon liabilities.

That leaves only one viable path forward:

Nuclear energy.

Reliable.

Always-on.

Geographically flexible.

Scalable to city-sized power output.

Just as the incandescent bulb needed wired grids,

AI needs nuclear grids.

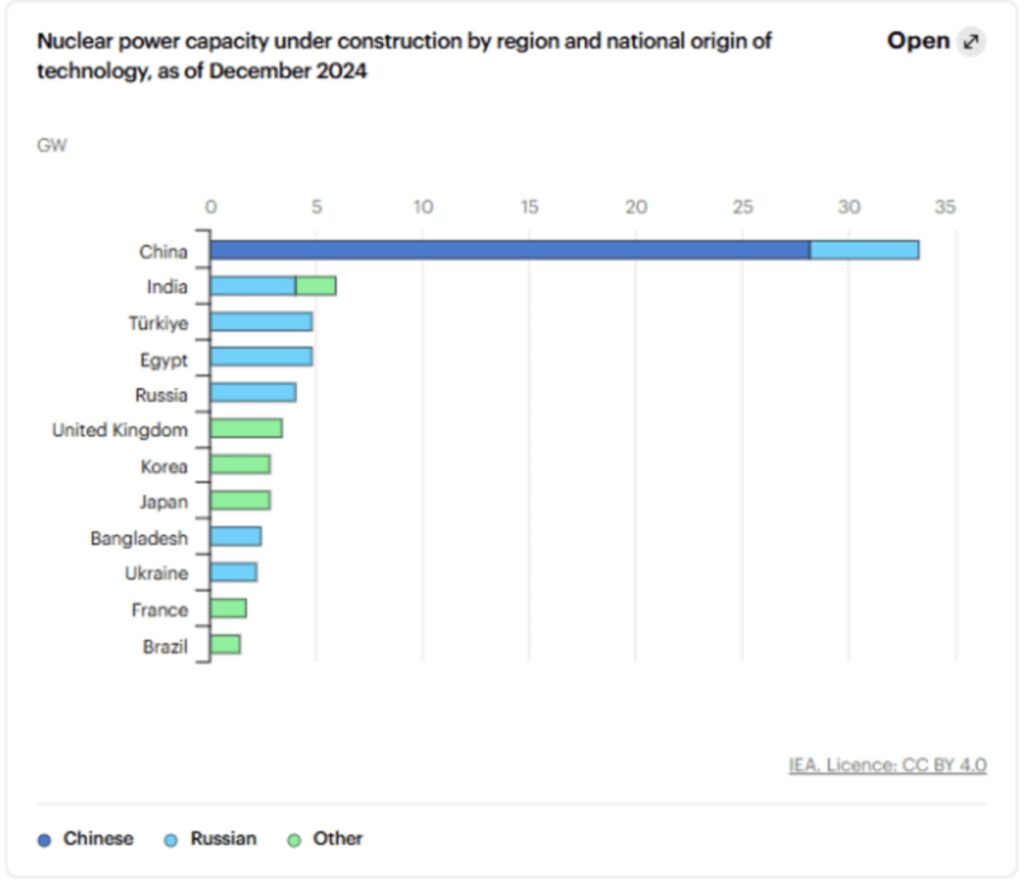

China Built Its Nuclear Future Early — and It Shows

While Western markets debated energy politics,

China executed a national nuclear strategy.

- Dozens of reactors were built in a single decade.

- National power generation surged.

- Energy infrastructure expanded at a pace the U.S. never matched.

If AI is an energy war,

China currently holds the early advantage —

because energy controls intelligence capacity.

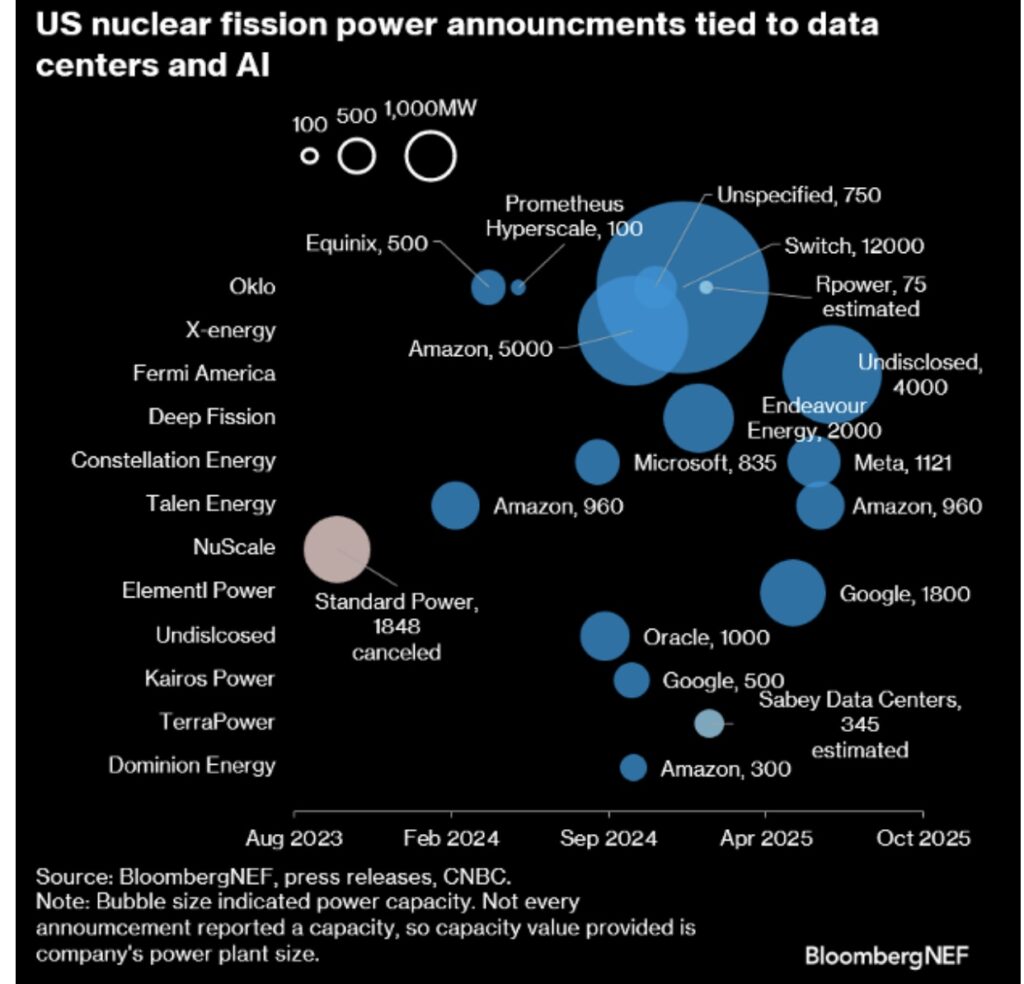

The Rise of Small Modular Reactors (SMRs)

The next era of nuclear isn’t giant Cold War megastructures —

It’s Small Modular Reactors:

- factory-built

- fast to deploy

- cheaper to operate

- able to sit beside industrial campuses and AI data centers

These reactors unlock a future where data clusters plug directly into a dedicated nuclear supply.

Think:

AI campuses powered like Netflix streaming servers —

nuclear on-site, not miles away.

It changes everything.

To reach the projected power required for large-scale AGI research,

The world may need hundreds to thousands of SMRs,

built across the American interior and the global tech corridor.

That means:

- uranium demand

- enriched fuel demand

- reactor manufacturing demand

- and decades of supply chain expansion

Investors should pay attention.

The New Strategic Fuel: Enriched Uranium for AI Infrastructure

Here is where it gets interesting.

Next-generation reactors require a new form of uranium fuel:

HALEU — High-Assay, Low-Enriched Uranium.

It delivers nearly four times the energy density of the old reactor fuel standard.

And right now, commercial HALEU supply is severely limited.

That scarcity is becoming one of the most important chokepoints in modern industry —

because the world cannot deploy advanced nuclear reactors without this fuel.

This is why uranium is no longer a commodity story.

It is a strategic resource story.

It is an AI infrastructure story. My previous article <<Borrowed-brilliance-the Openai-mirage>> read here.

Why One Company Sits at the Center of the Coming Boom

Among the few nuclear giants operating today,

One company stands out for sheer strategic positioning:

Cameco (CCJ).

It holds:

- enormous uranium reserves in North America

- high-grade deposits unmatched globally

- refining and conversion capacity

- partnerships in next-generation reactor development

- and exposure to the future HALEU supply chain

Think of it this way:

Edison didn’t get rich selling lightbulbs —

The fortunes were built by controlling power systems.

Cameco sits in that category today:

not a gadget company,

But a grid company.

The Uranium Market Has a Built-In Supply Shock

For decades, uranium production was underfunded.

Then nuclear demand returned,

But the mines didn’t.

Today:

- Energy security policies are accelerating.

- Utility contracts are tightening.

- Inventories are shrinking

- Warhead recycling is ending.

- Russian supply is restricted.

The setup resembles oil in the 2000s —

limited supply, rising strategic value, huge structural imbalance.

That is the kind of macro backdrop uranium investors dream about.

Why This Moment Looks Like 1882 Again

Edison’s world believed electricity would be slow, expensive, and unscalable.

They were wrong.

Today’s headlines say nuclear is too slow, too political, too complicated.

They are repeating history.

Electricity built the 20th century.

Nuclear will build the 21st.

And AI will run on that power.

We are early.

That matters.

Because the biggest fortunes in history were made by people who invested before everyone else understood the infrastructure shift:

- railroads

- oil pipelines

- telegraph lines

- telephone networks

- fiber optic cables

Today’s version of that wealth engine?

uranium mines,

nuclear fuel pipelines,

SMR construction networks,

and the companies positioned at the top of that chain.

Final Word: Intelligence Needs Power — Power Creates Wealth

Artificial intelligence will define the next century of growth.

But AI cannot run on hope.

It must run on electricity —

Only nuclear can deliver it at scale.

That makes the nuclear-uranium ecosystem

not just another investment theme,

But the backbone of the AI economy.

Investors who recognize this now

may be standing in the same spot Edison investors stood in 1882 —

holding a once-in-a-generation advantage.

And history — if it repeats — is about to be very kind to them.