The AI boom isn’t just happening in software. It’s showing up in concrete, steel, transformers, turbines—and increasingly, nuclear fuel. In 2025–2026, the world’s largest technology companies and utilities began treating electricity and data as strategic infrastructure rather than operating costs. The result looks less like a normal tech upgrade and more like a modern “electrification moment” for the AI age.

1) The new capex map starts with electricity and data centers

Power is the binding constraint.

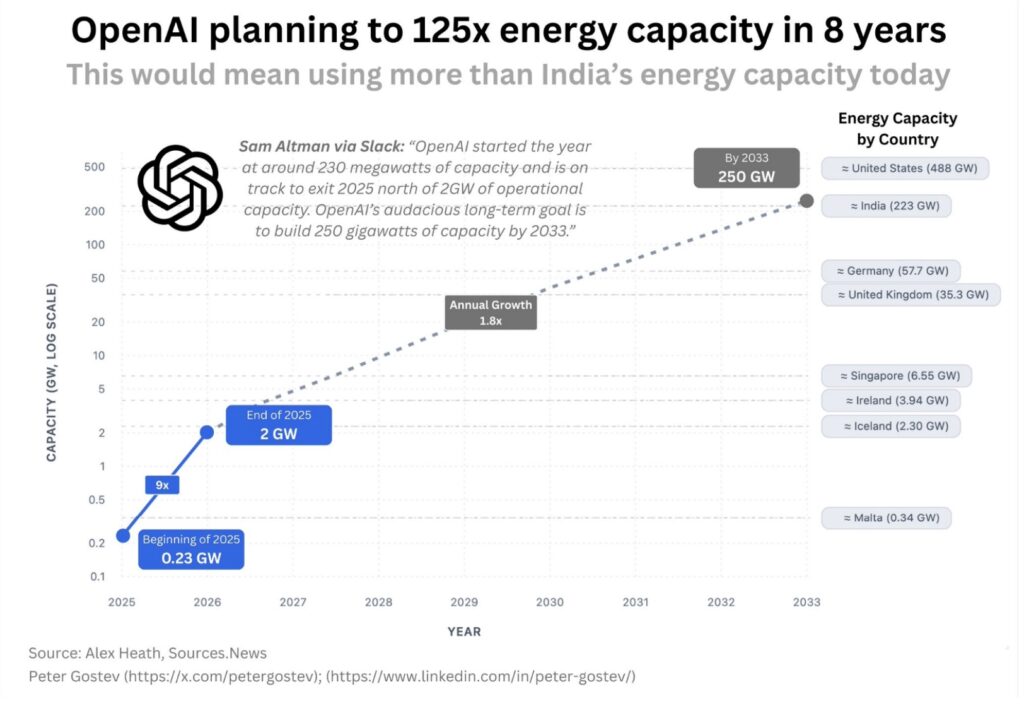

Data centers are no longer “just buildings with servers.” They are megawatt- to gigawatt-scale industrial loads that require long-lead grid upgrades, firm generation, and increasingly dedicated power procurement.

- S&P Global / 451 Research projected utility power provided to hyperscale, leased, and crypto-mining data centers would rise to ~61.8 GW in 2025, up roughly 11.3 GW in a single year, and nearly triple by 2030.

- Morningstar DBRS described U.S. electric utilities entering an investment “super-cycle,” estimating ~$1.4 trillion of utility spending from 2025–2030.

- Goldman Sachs highlighted accelerating power demand from AI and data centers as a catalyst for investment across nuclear, geothermal, fuel cells, storage, and other firm- and low-carbon technologies.

The data center buildout is already massive—and still accelerating.

McKinsey noted hyperscalers alone are expected to spend ~$300 billion in capex during 2025, reflecting the scale of the infrastructure race.

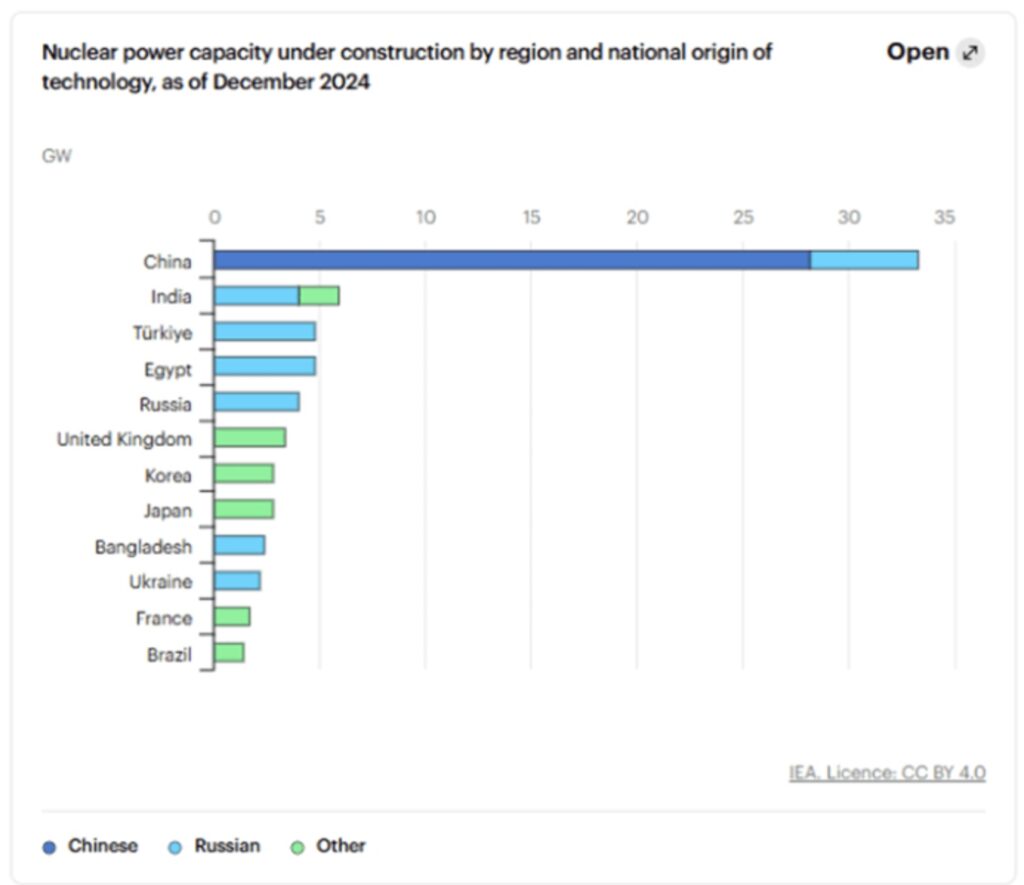

And power sourcing is becoming more direct and long-term. One of the clearest examples is the surge in nuclear agreements designed to secure firm electricity for AI loads:

- Reuters reported Meta signed long-term nuclear power agreements and SMR development collaborations, with a pathway to up to ~6.6 GW of nuclear power by 2035 tied to data center demand.

- AP similarly described the strategy as nuclear-backed supply for large AI data center clusters and detailed the scale and timelines of those reactor and plant commitments.

2) How electricity + data investment becomes AGI/ASI momentum

Think of the AGI/ASI race as a three-layer stack:

- Energy (watts) – can you power dense compute reliably, affordably, and at scale?

- Compute (chips + data centers) – can you deploy and operate GPU clusters fast enough?

- Data (truth + rights + provenance) – can your models learn from high-quality real-world signals without legal and security blowback?

The market has already priced in the first two layers—hence the historic capex into data centers and the utility “super-cycle.”

But the third layer—data quality, data rights, and data verification—is where the next bottleneck forms.

Why? Because the closer systems get to AGI-like performance, the more they must operate as decision engines in messy, adversarial real-world environments. That demands:

- Ground truth (what actually happened, when, and under what conditions)

- Traceability (where a data point came from and how it was transformed)

- Integrity (proof it wasn’t altered or injected)

- Rights & compliance (permission to use it, and defensible governance)

This is not theoretical. Even respected estimates show data centers could take a meaningfully larger share of national electricity consumption by 2030, with wide variance—highlighting the scale and uncertainty of the buildout.

When capex reaches this magnitude, investors and regulators start asking: What exactly are we powering—and can we trust it?

3) Data is the new oil—but only if it’s auditable, verified, and usable in the real world

The economic reality: unaudited data becomes a liability

Unaudited datasets create risks that scale with model capability:

- Model poisoning (malicious or manipulated inputs)

- Provenance gaps (no chain of custody; no defensible sourcing)

- IP and privacy exposure (training on restricted or sensitive data)

- Compliance fragility (regulators and enterprise buyers demand auditability)

As AI moves from “assistant” to “operator,” the cost of being wrong increases—financially, legally, and reputationally. That’s why the market is gradually shifting from “more data” to “better, governed, verifiable data.”

The technical reality: real-world data is the missing ingredient

AGI is not just text prediction. It needs:

- real transactions

- real supply chains

- real sensor readings

- real ownership records

- real identities (who did what, and who is authorized)

That’s why the most valuable datasets going forward will be those that are:

- anchored to real-world events

- verifiable and timestamped

- permissioned and attributable

- machine-readable for automated systems

4) Where Made in USA Inc.’s Data Wallet fits in this cycle

This is the strategic role of Made in USA Inc.’s Data Wallet concept: treating products, entities, and records as verifiable “data containers” that can carry trusted attachments—such as provenance, certifications, ownership, and event histories—throughout their lifecycles.

In plain terms, a data wallet approach aims to make information:

- auditable (you can prove what’s inside and how it got there)

- tamper-resistant (changes are traceable)

- permissioned (access and usage can be governed)

- portable (the verified record travels with the asset/product)

That matters because the AI economy is converging on a simple truth:

Compute scales intelligence.

Verified data scales trust.

Trust unlocks deployment.

When enterprises, regulators, and investors look at AGI/ASI trajectories, the winners won’t just be the firms that buy the most GPUs—they’ll be the firms that can feed models high-integrity real-world data that is clean enough to operationalize and defensible enough to monetize.

Closing: The next “AI moat” is verified reality

Electricity and data center capex are building the physical engine of the AI economy.

Nuclear contracts and grid investment are emerging as strategic responses to the AI load curve.

But the final unlock for AGI/ASI will not be watt-hours alone.

It will be audited, verified, and based on real-world data—data that can be trusted, traced, and legally used at scale. And that’s exactly why “data wallet” infrastructure—like the approach Made in USA Inc. is building—belongs in the same conversation as power plants and data centers: it’s part of the critical path from AI hype to AI civilization-scale utility.