In every technological revolution, there comes a moment when experimentation ends, and infrastructure begins. For crypto, that moment arrived in 2025.

After two years of regulatory uncertainty, capital contraction, and public skepticism, the digital asset industry quietly re-entered the financial mainstream. Institutional adoption accelerated. Venture capital returned. Banks reopened their engagement. Regulatory frameworks have matured. And most importantly, crypto’s role evolved from speculative frontier to emerging financial backbone.

As we enter 2026, the narrative is no longer about “if” blockchain integrates into global finance, but how quickly and who controls the rails.

This report summarizes the structural shifts of 2025 and outlines the capital flows, market sentiment, and policy-aligned growth sectors shaping crypto’s next phase — particularly under the emerging regulatory clarity ushered in by the Clarity Act and its companion frameworks.

2025: The Year Crypto Rejoined the Financial Mainstream

2025 marked crypto’s re-entry into institutional portfolios, corporate balance sheets, and financial infrastructure planning.

Three forces defined the year:

- Regulatory clarity replaced regulatory ambiguity.

- Institutional capital returned at scale.

- Enterprise use cases moved from pilot to production.

The result: crypto stopped behaving like a speculative niche and started functioning like an alternative financial system under construction.

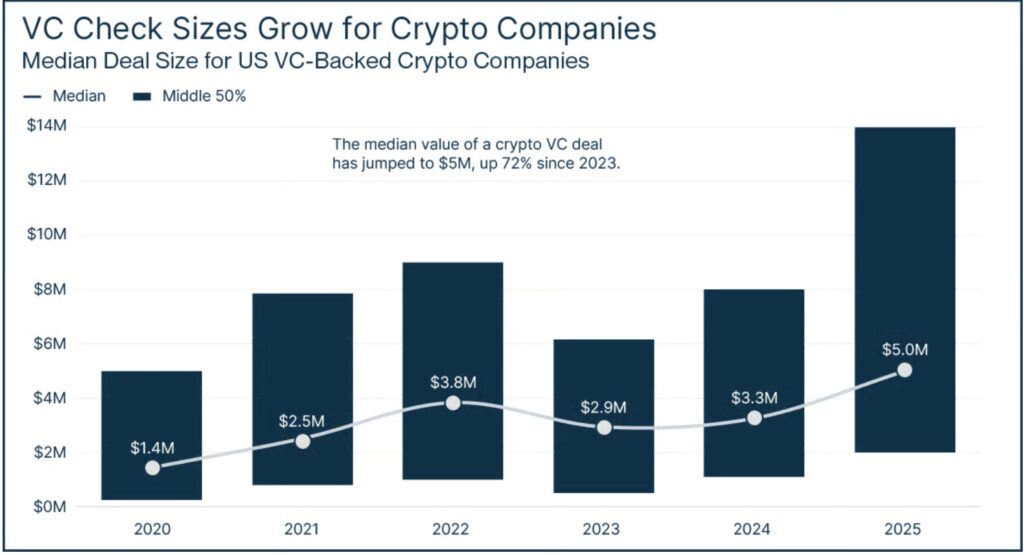

Capital Returns: Venture Funding Rebounds with Institutional Focus

After two dormant years, venture capital re-entered the crypto sector in 2025 — but with a new discipline. Rather than scattering capital across thousands of early-stage experiments, investors concentrated larger checks into fewer, more mature, infrastructure-oriented companies.

Median valuations rose sharply. Late-stage rounds expanded. Follow-on funding rewarded proven teams serving institutional demand rather than retail speculation.

This shift signals a maturing industry:

Product-market fit is now driven by enterprises, not hype cycles.

Institutional Adoption Goes Vertical

Corporations no longer treat crypto as peripheral exposure. They are integrating digital assets directly into treasury, settlement, custody, lending, and payments operations.

Public companies increased Bitcoin holdings as treasury reserves.

Banks launched crypto custody.

Brokerages added on-chain settlement.

Prime brokers introduced crypto-collateralized lending.

A new category emerged: Digital Asset Treasury (DAT) companies — firms that treat crypto accumulation as a core operating strategy rather than a side allocation.

At the same time, large financial institutions began offering crypto services natively, preparing full-stack integration across:

- Custody

- Settlement

- Lending

- Brokerage

- Treasury operations

This is verticalization — ownership of the entire financial stack.

Source: PitchBook Data, Inc. and SVB analysis

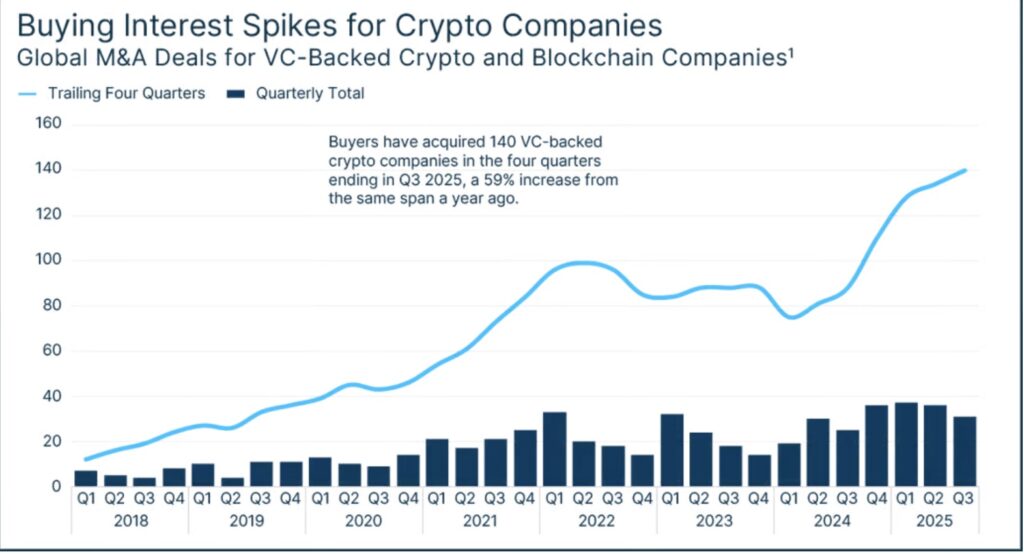

M&A and Charter Acquisition: The Race to Build Full-Stack Crypto Banks

Instead of building capabilities from scratch, incumbents and crypto-native leaders accelerated acquisition strategies.

Exchanges acquired derivatives platforms.

Payment firms acquired stablecoin infrastructure.

Custody providers acquired banking charters.

Regulators reinforced this trend by granting digital-asset banking trust charters and moving stablecoin issuance and custody within the federal banking perimeter.

The outcome:

A new class of full-stack crypto financial institutions is emerging — blending the speed of blockchain with the compliance of traditional banking.

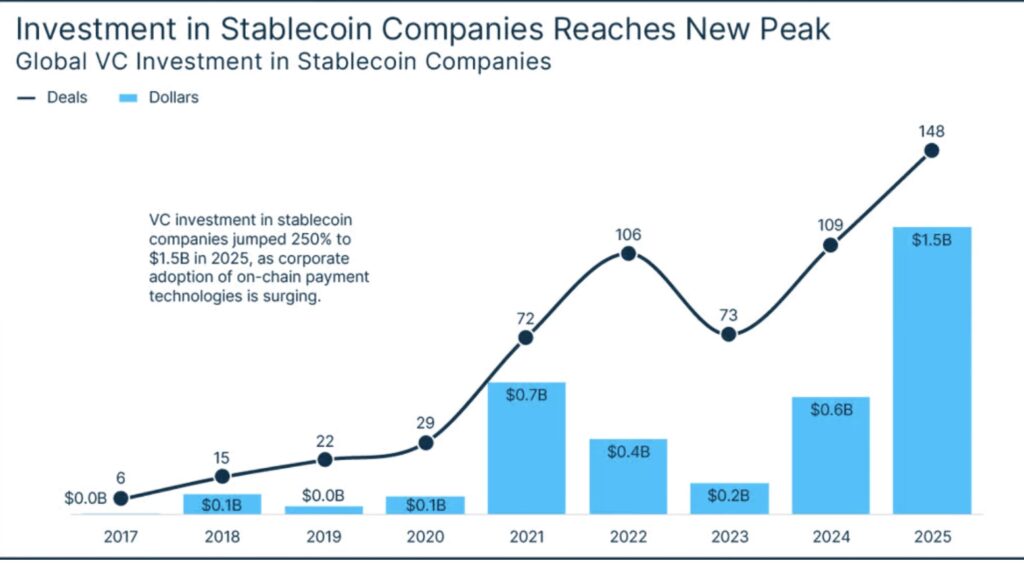

Stablecoins: The Internet’s Native Settlement Layer

If Bitcoin became digital gold, stablecoins are becoming digital cash for the global internet economy.

In 2025, global stablecoin settlement volumes surged. Corporations adopted on-chain dollars for:

- Cross-border payments

- Treasury liquidity

- B2B settlement

- Real-time cash management

Regulatory frameworks such as the GENIUS Act — aligned with the broader objectives of the Clarity Act — established federal guardrails for issuance, reserves, and compliance.

With regulatory certainty in place, banks and fintech firms began issuing stablecoins, while “Stablecoin-as-a-Service” infrastructure attracted record venture funding.

By 2026, tokenized dollars will graduate from pilot projects into enterprise financial plumbing.

Real-World Asset Tokenization: Wall Street Moves On-Chain

Another defining structural shift: tokenization of traditional assets.

Treasuries, money market funds, private credit, real estate, and even equities are now being represented as blockchain-native instruments.

Tokenization unlocks:

- Fractional ownership

- Instant settlement

- Lower administrative costs

- Continuous liquidity

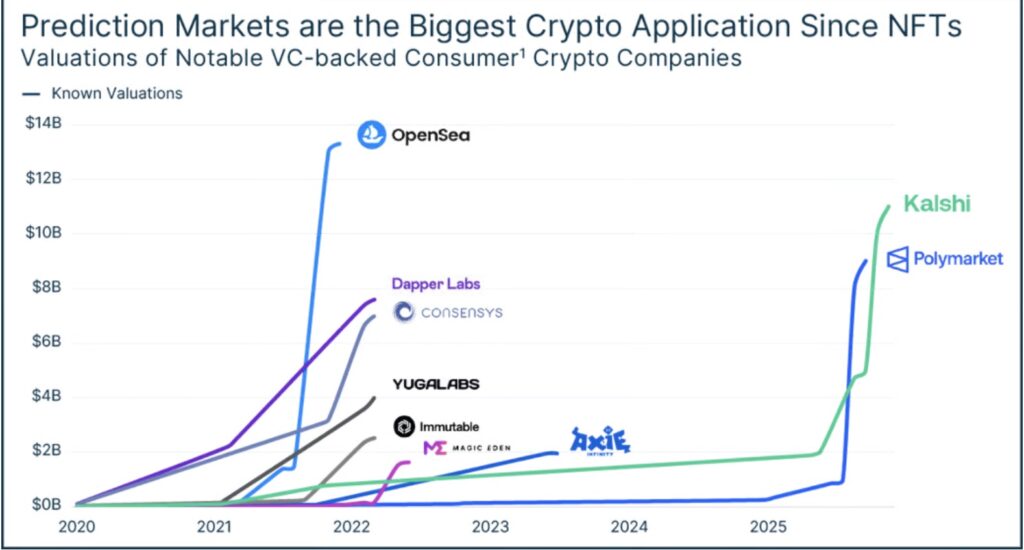

Major asset managers have launched tokenized treasury funds. Brokerages have introduced tokenized equity trading. Prediction markets and private market tokenization platforms have reached multi-billion-dollar valuations.

This convergence signals the gradual unification of traditional finance and blockchain settlement networks.

Source: PitchBook Data, Inc. and SVB analysis

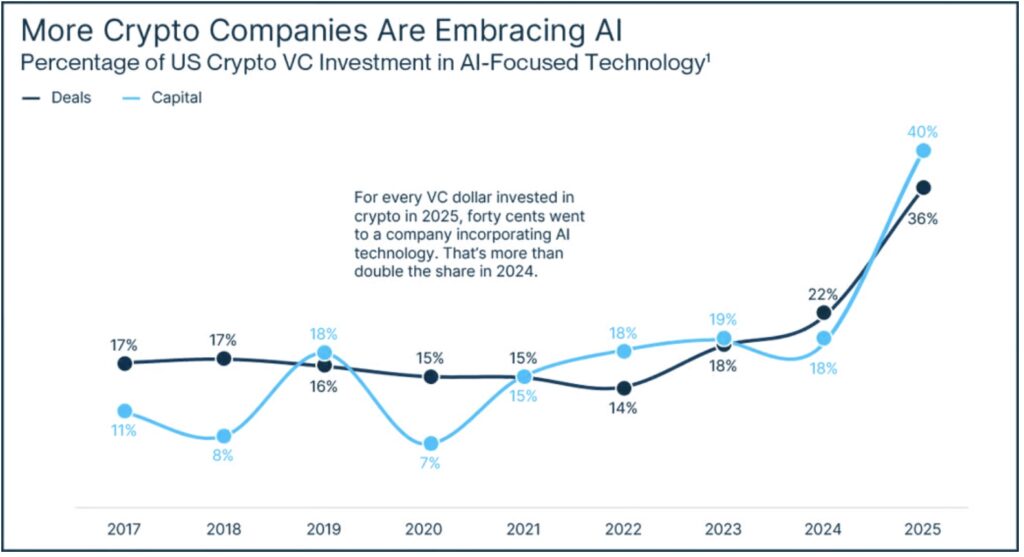

AI + Crypto: The Birth of Machine-Native Commerce

The next frontier of digital commerce will not be built solely for humans.

AI agents are beginning to:

- Hold wallets

- Manage digital assets

- Execute payments

- Verify data

- Coordinate transactions autonomously

At the same time, blockchain infrastructure is emerging as the trust layer for AI content provenance, identity verification, and data authenticity.

This convergence of AI and crypto is unlocking:

- Autonomous agent economies

- On-chain AI service markets

- Verified data provenance systems

- Decentralized physical infrastructure (DePIN) serving AI compute demand.

By 2026, the most successful consumer applications will not market themselves as “crypto apps.” They will feel like modern fintech — powered invisibly by blockchain settlement and verified data rails.

Source: PitchBook Data, Inc. and SVB analysis

Policy Alignment: The Clarity Act and the Era of Regulated Blockchain Infrastructure

Perhaps the most underestimated catalyst in 2025 was policy alignment.

The Clarity Act and related regulatory frameworks are drawing firm boundaries between:

- Securities vs. commodities

- Custody vs. brokerage

- Issuance vs. settlement

- Compliance vs. innovation

For the first time, institutions can build with confidence. Capital can deploy at scale. And blockchain infrastructure can integrate directly into national financial systems.

This regulatory maturation transforms crypto from speculative experimentation into auditable, compliant, enterprise-grade infrastructure.

Market Sentiment Entering 2026

The market’s emotional posture has shifted.

Fear and skepticism have been replaced by:

- Strategic accumulation

- Infrastructure deployment

- Long-term capital commitment

- Institutional product development

Volatility remains — but beneath price movement, the foundation is strengthening.

Crypto is no longer a trade.

It is becoming financial architecture.

The Road Ahead

In 2026, winners will not be determined by token narratives.

They will be determined by:

- Who controls settlement rails?

- Who provides compliant custody?

- Who verifies real-world data?

- Who bridges traditional assets on-chain

- Who enables machine-native commerce?

This is the next phase of blockchain’s evolution:

From expectation → to pilot → to production → to infrastructure.

BitVision Perspective

At BitVision, we believe the defining asset of the next decade is not merely digital currency — but verified, compliant, real-world data flowing through blockchain settlement networks.

As institutions build the financial operating system of the future, the demand for trusted data provenance, on-chain compliance, and real-world verification will only accelerate.

The truth economy is arriving — and the rails are being laid now.

Closing Thought

In every industrial revolution, those who control infrastructure create lasting value.

In the digital financial revolution, blockchain is the infrastructure, and verified data is the currency of trust.

2026 is not the next crypto cycle.

It is the beginning of the crypto operating era.