While headlines focus on soaring metal prices, a more powerful story is unfolding quietly beneath the surface:

Silver miners are experiencing exponential profit expansion — not linear growth.

In commodity cycles, price moves are only the first act.

Real wealth is created when rising prices collide with fixed extraction costs. And in today’s silver market, that collision is producing something rare:

A mining profit supercycle.

From Rising Prices to Exploding Margins

Over the past year, precious metals have delivered historic moves.

Gold advanced roughly 70%.

Silver surged more than 130%.

Yet most investors underestimate what this means for miners. Mining profitability does not rise in step with metal prices — it rises by multiples.

Why?

Because extraction costs remain relatively stable while selling prices climb dramatically.

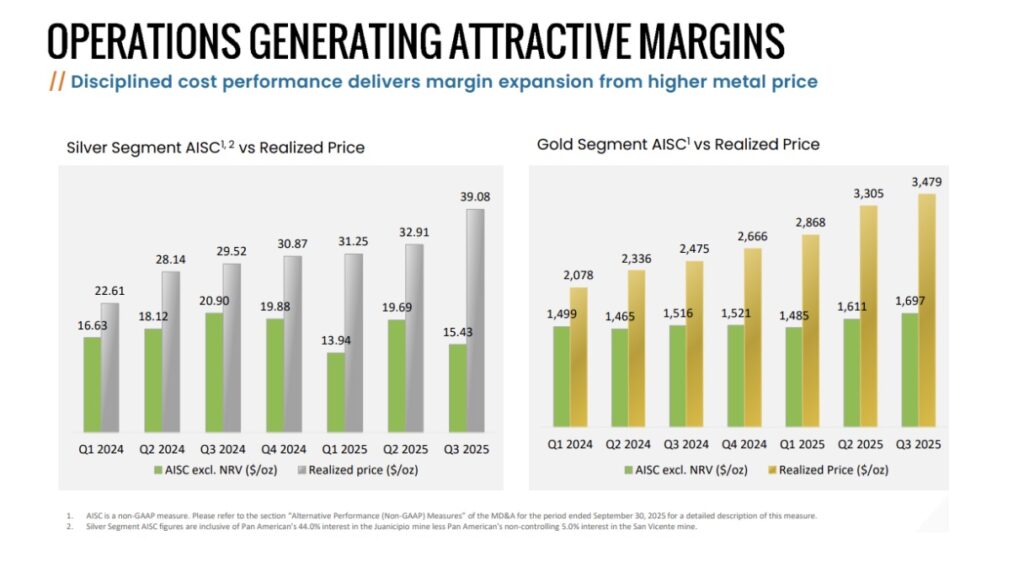

Consider a large-scale silver producer. The industry’s key metric is All-In Sustaining Cost (AISC) — the approximate total cost to mine one ounce. Across major producers, silver AISC currently sits near $16 per ounce.

At a $22 silver price, margins are modest.

At $40 silver, margins triple.

At $80 silver, margins become extraordinary.

This is operational leverage at its purest form.

If silver prices remain elevated into 2026, many producers will see profit per ounce expand nearly tenfold compared to early 2024 levels.

This is not speculation.

It is simple industrial arithmetic.

Cash Flow at Industrial Scale

Large producers today operate multi-million-ounce output lines. At current silver prices, quarterly operating cash flow from silver alone can reach hundreds of millions of dollars — before accounting for additional gold, zinc, or copper by-products.

This transforms balance sheets rapidly:

- Debt disappears

- Treasury reserves expand

- Capital returns accelerate

- Strategic acquisitions multiply

In short:

Mine becomes money-printing infrastructure.

The Hidden Tailwind: Cheap Energy

Mining is energy-intensive.

Diesel, gasoline, and electricity represent up to 15% of operating costs.

With oil trading at relatively low levels, miners are enjoying a cost environment rarely seen during past precious-metal bull markets. In the 1970s, fuel costs were significantly higher — yet miners still performed spectacularly.

Today’s combination of:

- High metal prices

- Stable extraction costs

- Affordable energy

creates a near-ideal production environment.

Why Established Producers Win This Cycle

Building a new mine remains a decade-long labyrinth of permitting, financing, and political risk. This reality dramatically increases the value of existing long-life producing assets.

As a result, this cycle strongly favors:

Large, operating producers with established mines

Not speculative explorers are still years from production.

Existing mines are real industrial assets in a world waking up to physical scarcity.

Where the Cash Goes Next

As free cash flow floods in, mining companies tend to allocate capital in four directions:

- Debt reduction — strengthening financial resilience

- Mergers & acquisitions — securing future reserves

- Dividend growth — returning capital to shareholders

- Executive compensation — which investors must monitor carefully

The first three reinforce long-term value.

The fourth requires governance discipline — but the industry, after a decade of austerity, remains relatively lean.

A Structural Supply Story

Silver is not merely a precious metal.

It is also a strategic industrial material:

- Solar panels

- Semiconductors

- EV components

- Advanced electronics

This dual role means silver demand is now tethered not only to monetary cycles but also to the build-out of electrification and AI infrastructure.

Energy, data, and silver are converging into one supply narrative.

The Investment Implication

If silver holds above $70 into 2026, miners will continue to aggressively compound cash flows.

If silver moves toward $100+, profit expansion becomes nonlinear.

In such environments, the largest gains typically accrue not to metal holders — but to high-quality producers with scalable output.

This is why, despite already substantial gains, many long-term investors continue holding mining positions. The math suggests the strongest phase of cash generation may still lie ahead.

Final Thought

Markets often chase narratives.

But wealth cycles are built on industrial realities.

Today, silver miners sit at the intersection of:

- Physical scarcity

- Energy transition

- Monetary uncertainty

- Industrial electrification

That combination is rare.

And powerful.

The silver mining sector has quietly entered a profit supercycle — and the broader market is only beginning to notice.