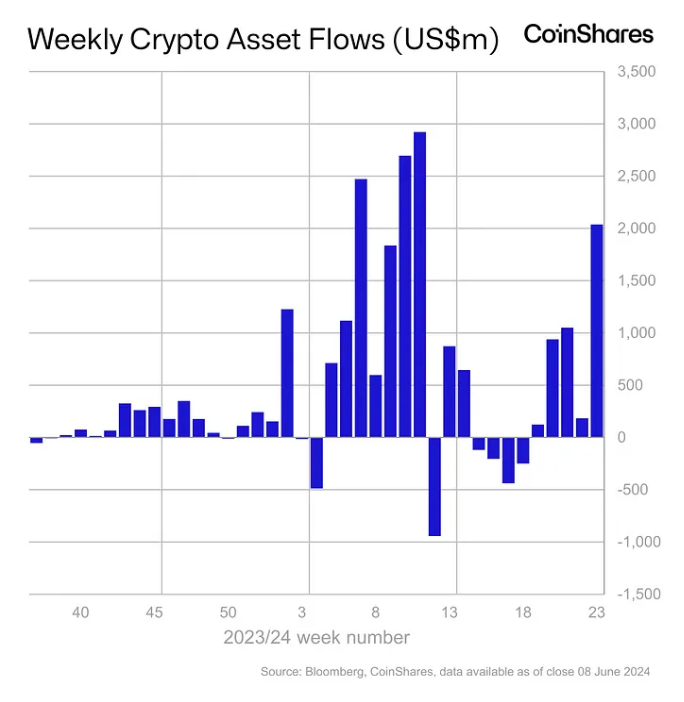

Hello, crypto enthusiasts! Buckle up because Bitvision is here to break down the whirlwind week in digital assets. Spoiler alert: it’s been nothing short of a financial fiesta, with a staggering $2 billion pouring into crypto investment products. Let’s dive into the juicy details.

The Big Bucks and Bitcoin Bonanza

Last week, crypto investment products were the belle of the ball, attracting a record-breaking $2.5 billion in inflows. According to CoinShares, this marks the highest weekly inflow since the launch of spot Bitcoin ETFs in January. And who’s been the star of the show? You got it, Bitcoin! The mighty BTC ETFs led the charge with an incredible $1.1 billion inflow, pushing their year-to-date total to a jaw-dropping $2.8 billion. It’s pretty for a digital currency that started from humble beginnings, right?

Who’s Leading the Charge?

BlackRock and Fidelity have been duking it out at the top in the race to bag the most inflows. BlackRock snagged $693.6 million, while Fidelity wasn’t far behind with $522.6 million. It’s like watching two heavyweight champions slug it out, except the prize is piles of digital gold.

Ethereum and Friends: The Sidekicks

While Bitcoin basked in the limelight, Ethereum and Cardano played their part as the trusty sidekicks. Ethereum-related products saw some decent action, though they were left holding Bitcoin’s coat. Still, with inflows trailing far behind Bitcoin, they have some catching up.

The AUM Ascendancy

Here’s a fun fact to drop at your next crypto-themed cocktail party: the total assets under management (AUM) for these investment products hit $67 billion. That’s the highest since the heady days of December 2021. So, if you thought the crypto craze was cooling off, think again. It’s hotter than ever.

Spot Bitcoin ETF Flow

source: The Block

Updated: June 10, 2024

Short Sellers: The Unsung Heroes

In the shadows, traders shorting Bitcoin experienced minor outflows of $0.4 million. It’s not the headline act, but it adds a layer of intrigue—like finding out your favorite movie has an alternate ending.

Global Glimpses

Unsurprisingly, the United States dominated the inflow landscape, accounting for 99% of the week’s haul. Switzerland and Germany contributed $16.7 million and $13.3 million, respectively, while Sweden went rogue with $26.3 million in outflows. Someone needs to send them a memo about joining the party.

What Does It All Mean?

In summary, the crypto market is buzzing with excitement and cash. Investors are piling in, driven by the potential for a rate cut and the booming popularity of spot Bitcoin ETFs. Whether you’re a seasoned trader or a newbie, the message is clear: the crypto train is roaring ahead, and it’s not showing signs of slowing down.

So, keep your eyes on the prize, stay smart, and happy trading! Stay tuned to Bitvision for more insightful, witty marketing movement takes on crypto.