XRP is no longer just a retail trader’s asset.

A growing number of public companies are now putting it on their balance sheets.

The latest SEC filings reveal a trend that could reshape corporate treasury strategy.

The New Wave of Holders

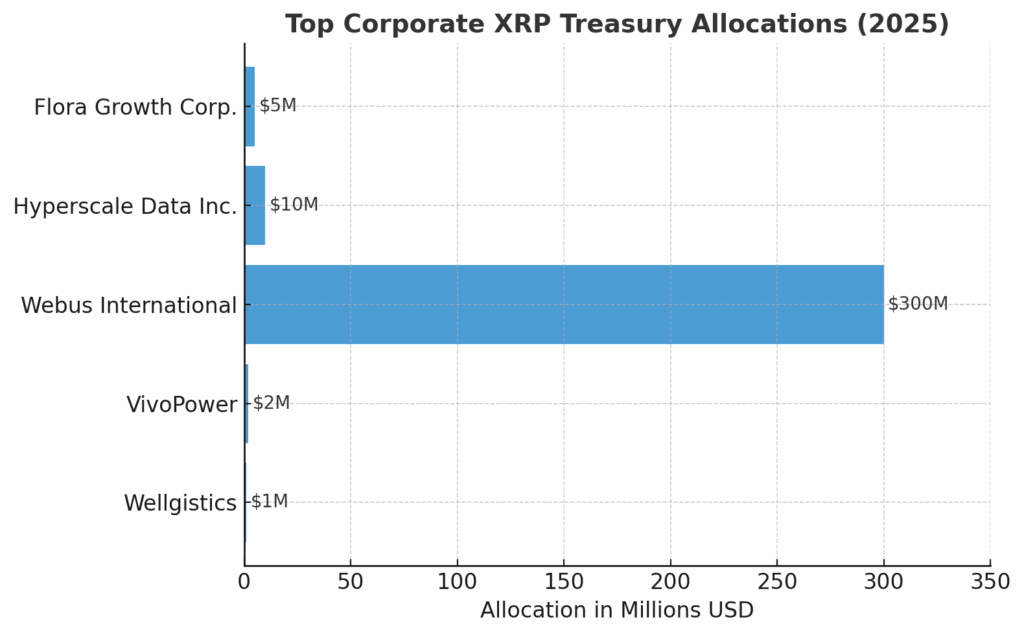

- Flora Growth Corp. disclosed XRP holdings alongside Ethereum and Solana in its Form 10-Q.

- The goal: strengthen financial resilience while diversifying away from fiat risk.

- Hyperscale Data Inc. is going further.

- Through its subsidiary Ault Capital Group, it plans to buy $10 million worth of XRP, with monthly transparency reports starting August 2025.

- Webus International filed a Form 6-K revealing a $300 million XRP treasury allocation.

- This news is one of the most significant public commitments to date.

Other firms—VivoPower and Wellgistics—have also confirmed XRP holdings.

They are betting on blockchain’s ability to deliver faster, cheaper, and more secure cross-border payments.

Top corporate XRP treasury allocations in 2025:

Why Now?

Legal clarity has changed the game.

The Ripple vs. SEC ruling in 2023 confirmed XRP is not a security in certain transactions.

Institutional custody solutions, like BDACS, make onboarding easier.

XRP is also gaining liquidity in Asia, listed on Korea’s Upbit, Coinone, and Korbit.

And behind this momentum is leadership.

Ripple CEO Brad Garlinghouse continues to position XRP as the bridge asset for the future of payments.

The Bigger Picture

Corporate move into XRP is more than diversification—it’s positioning for a blockchain-driven payments future.

Corporate finance teams are studying settlement speed, transaction cost, and liquidity depth.

XRP settles in 3–5 seconds with fees near zero.

In volatile currency environments, that speed is a hedge.

The movement of large XRP wallets also reveals where the smart money is going.

Our earlier analysis, Silent Exodus: Where Is the XRP Going?, tracks these flows in detail, often months before the market reacts.

Looking Ahead

Expect more corporate disclosures in Q3 and Q4.

Once early movers prove the benefits, others will follow.

The adoption curve in 2025 may mirror Bitcoin’s corporate wave of 2020, only faster.

With your planned YouTube deep dive on Ripple’s fintech role and XRPL’s functions, readers will see the whole picture:

How technology, regulation, and corporate strategy are converging on XRP.