Subtitle: Digitizing Oyster Power and Turning Pollution into a New Asset Class

Introduction “To Catch a Pearl” — the name plays off Alfred Hitchcock’s To Catch a Thief, filmed in the same French Riviera hills where Robinhood CEO Vlad Tenev just dropped a generational disruption. But unlike the stolen diamonds of the film, this time, it’s not gold or stock—it’s clean water that holds hidden value.

Beneath the murky surface of our industrial age lies an unrecognized treasure: the humble oyster. With each gallon of water, it filters, it quietly generates a measurable ecological service. Now, thanks to blockchain and AI, those services can be verified, digitized, and monetized. Welcome to the new era of tokenized nutrient credits—where polluters fund nature, and oysters become economic agents.

The Invisible Cost of Pollution Nitrogen and phosphorus runoff from agriculture, factories, and wastewater systems creates dead zones in our oceans and rivers. Algae blooms choke aquatic life. Drinking water becomes unsafe. Yet most of this pollution is undocumented, unpriced, and unpunished.

Traditional environmental enforcement is clunky: slow inspections, paper trails, and inconsistent penalties. What the world needs is a fast, accountable, data-driven system that turns pollution into economic consequences.

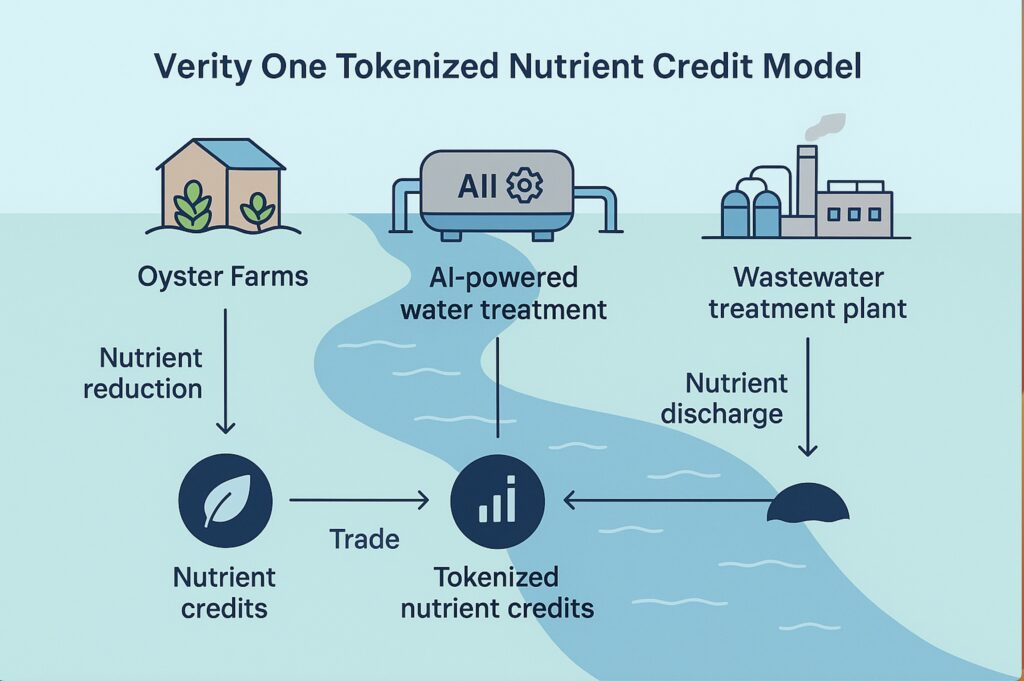

Enter Nutrient Credits: A Marketplace for Clean Water Nutrient credits are digital units representing a verified reduction in nutrient pollution. When a polluting facility exceeds its discharge limits, it must either clean up—or buy credits from someone who has gone beyond its mandate to reduce pollution. That “someone” might be a regenerative farmer, a wetland restoration project, or now—an oyster farm.

This tokenization oyster isn’t charity. It’s smart economics:

- Buyers meet compliance affordably

- Sellers earn from ecological stewardship

- The planet wins from lower pollution

Source: Verity One

But for this to work, it needs trust, measurement, and transparency—enter Verity One.

Verity One: Turning Oysters into On-Chain Assets

Step 1: Data Collection

IoT sensors measure nitrogen and phosphorus reduction at oyster farms and treatment plants. AI processes the data in real-time.

Step 2: Verification

Verity One audits the data and verifies the impact using blockchain. Using this Technology ensures trust with regulators, buyers, and investors.

Step 3: Tokenization

Each verified reduction becomes a digital token—a nutrient credit—with full traceability and audit history.

Step 4: Marketplace

Polluters purchase credits on Verity One’s exchange. All transactions are logged and visible via a transparent dashboard.

Step 5: Impact

Oysters keep filtering. Nature heals. And capital finally flows toward regeneration, not destruction.

Source: BitVision.ai

The Pearl in the Shell: Why Oysters Matter A single oyster filters up to 50 gallons of water per day. But until now, no one paid them for it. With Verity One’s model, that natural service becomes an income stream. This digitizing isn’t theoretical—it’s biology digitized.

Oyster farms, once seen as a niche form of aquaculture, are now frontline infrastructure for climate resilience and clean water—ready to earn from every gallon of clean water produced.

From Carbon to Clean Water: The New Environmental Asset Class. Carbon markets have proven that emissions reductions can be priced, traded, and scaled. Nutrient credits are the next frontier. However, unlike carbon, they can be directly linked to local ecosystems and human health.

From the Chesapeake Bay to the Yangtze River, the idea is spreading: if you pollute, you pay. If you regenerate, you earn.

Explore nutrient credit frameworks from the U.S. EPA.

For a deeper dive into the economic awakening around clean water, see our previous report: Blue Gold Rush: Investing in the Next Great Commodity.

Conclusion: Catching the Future “To Catch a Pearl” is more than a headline—it’s a glimpse into a regenerative economy powered by biology, digitized by AI, and secured by blockchain.

Verity One isn’t just selling tech—it’s offering a vision. Where every drop is filtered, every oyster is grown, and every pollution credit is tokenized, creating value you can trace, trust, and trade.

The future of environmental finance has arrived. And this time, it’s powered by shells, not spreadsheets.